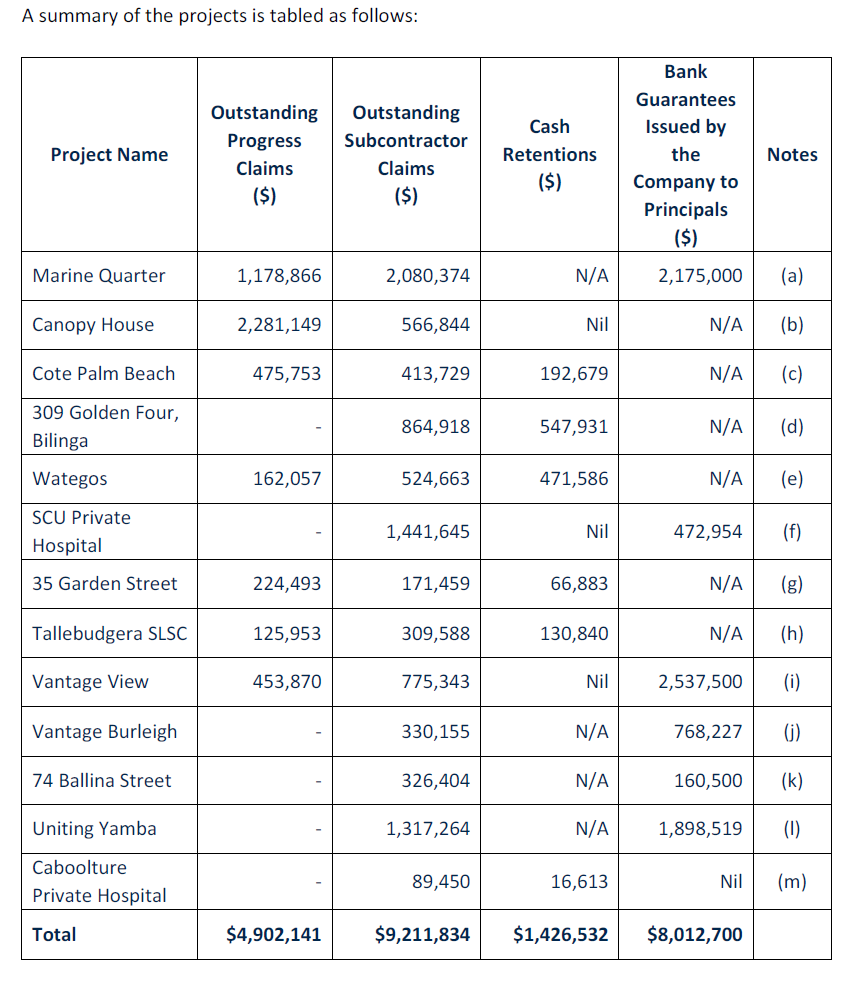

On page 14 of SVPartners "GCB Constructions report to creditors dated 22-08-23", they have clearly set out what the company's position was in regard to Cash Retentions and bank guarantees locked in for various projects that GCB were working on.

It also sets out GCB's outstanding progress claims and outstanding subcontractors claims for those projects.

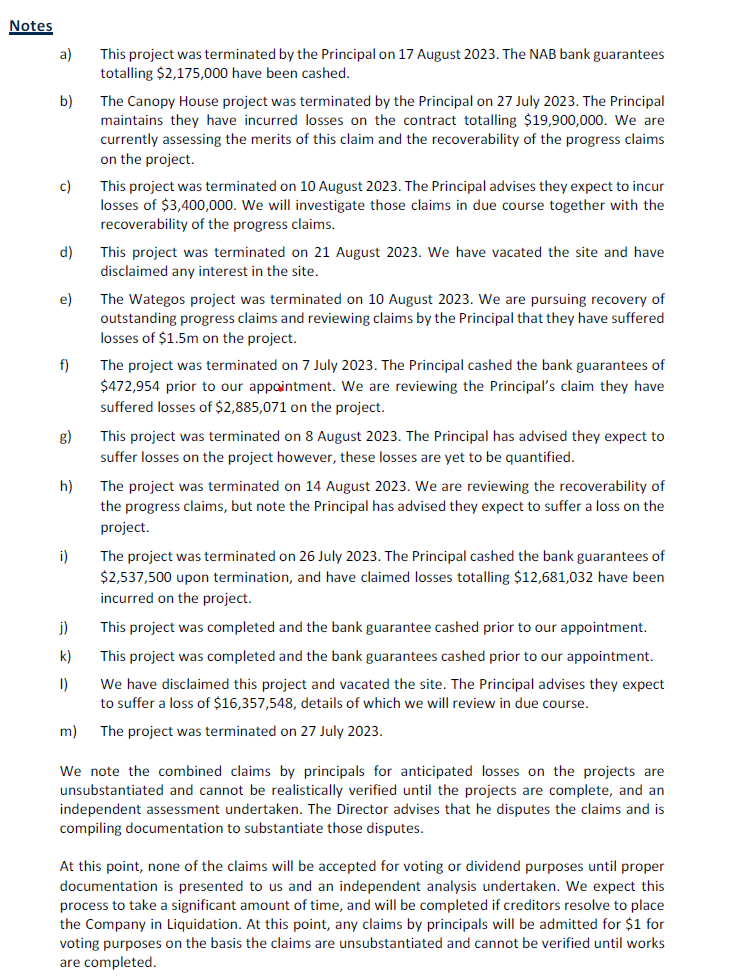

It also sets out on page 15 what happened to those retentions and bank guarantees and its somewhat of a first to have it all so easily accessible.

It is our position that all retentions amount to nothing but blackmail.

The total of retentions issued by GCB is almost 9.5 million dollars.

The fundamental question;

What effect would that 9.5 million have on the solvency of this company?

In other words, if GCB had that money in its accounts instead of tied up in trust and unusable, would they have survived?

On page 15 there is a summary of what happened to these retentions;

In 2 instances the projects were completed but the bank guarantee's cashed prior to SVPartners appointment.

Its ok to say that the company's debts and losses are too big for 9.5 million to make a difference, but that is after administration when all the debts became payable.

Its a simplistic view, but on that table alone, if GCB did not have an obligation to issue cash retentions and bank guarantees to developers and developers had paid the builders outstanding progress claims:

- All subbies claims "for those projects" could have been paid in full

- GCB would have had 5.2 million in the bank

Retentions were part of our submission to a recent Senate Committee on corporate insolvency. We are not saying this is what happened to GCB but it does happen regularly.

Some benefits to the developer

- The Developers withholds retentions from the Builder

- Developers can obtain financial advantage by not paying them progress claims until the builder goes into insolvency, particularly when the project is close to being complete.

- The start of the process is to short pay or “drip feed” the Builder during the course of the project, all the while withholding retentions as well.

- Close to the end of the project the Developer simply stops paying progress claims and the builder goes into liquidation.

- The benefits accruing to the Developer are:

- The accumulated amount the Developer has short paid the Builder along the way;

- The retentions it is holding,

- The value of say the last progress payments it failed to pay.

- The value of goods, materials and labour that have been provided by subcontractors and suppliers but not paid for, in this case almost 5 million.

- Cashing in the bank guarantees and cash retentions provided by the builder.

- While a subsequent builder who finishes the project may charge more to finish the work, the developer is still financially ahead.

Theoretically, the liquidator may claim unpaid amounts from the Developer but they will enter into a settlement that is still advantageous to the developer.

And as always, as you can see from the above tables, the big losers are the subcontractors at the end of the supply chain who are unsecured creditors and lose their monthly claims and of course, their retentions kept by the builder.

6 Month Relation Back Period

To add insult to injury, the liquidator as is his legal duty, will then comb through all payments in the 6 month relation back period and sue any subbie who made a noise about payment and were lucky enough to be paid.

Another fundamental question is;

Why would anyone be a subcontractor when the deck is so heavily stacked against them?

Its time that Government got off their shiny fat arses and as a minimum, changed the laws around retentions and preferential payments.

After all, builders can always pursue subcontractors through the normal channels, ie: QBCC or legal means if they refuse to return to site for repairs.

Subbies add a level of protection to your business and join SubbiesUnited and make use of our private members forum for up to date information.

But a warning, if you are NOT a subcontractor, DO NOT JOIN, you will not have access until we approve you and in the approval process, we will weed you out, you are not welcome.

Note: More membership applications are rejected than those that are accepted so stop wasting our time. SubbiesUnited is for subcontractors only!

Leave a Reply

You must be logged in to post a comment.