Fighting for Subbies Rights

Updated 08.03.2018

We would like to thank those subbies who took the time to vote with us for a better outcome, you have covered yourselves in glory and this is not the end, its only the beginning.

At yesterdays 2nd creditors meeting Grant Thornton, the CRCG administrator ignored the wishes of the unsecured creditors when the vote for and against the Deed of Company Arrangement (DoCA) was deadlocked at 23 votes for the DoCA and 23 votes against.

His casting vote could potentially cost subbies millions of dollars and that is money saved by CRCG.

He had the deciding vote and cast it in favour of CRCG's miserable 8 million offer and they wonder why we have a very low opinion of liquidators. They don't have the guts for the fight.

The votes for the DoCA were bolstered by friendly developers but the votes against were predominately unsecured subcontractor creditors.

The Administrator Can't Count

The vote was a farce.

When the vote was counted the administrator got the "against" count wrong as you would expect, he certainly wouldn't have got the "for" count wrong.

He only managed to count 22 but ran out of fingers and toes at 20, hence the confusion.

He had the vote 23 for and 22 against the DoCA until it was pointed out that SubbiesUnited advisor and industry expert Rob Berry and other unsecured creditors held 23 votes against so after a recount (this time with his shoes off) it was 23 votes all.

Value

One thing we cannot understand is that at the first creditors meeting, a developer voted in favour of CRCG with the incumbent administrators retaining the job;

- At that meeting the administrator admitted the developers debt for 2.5 million but yesterday when that developer voted with subbies against the DoCA,

- He admitted the developers debt for only $3, one dollar for each project he had going.

- That was a reduction of $2,499,997 from the first creditors meeting to this one based on the subjective adjudication and on a whim from the administrator.

Administrator please explain to us dumb subbies how that vote was worth 2.5 million 3 months ago when it suited your agenda but this time around it was only worth $3.

There is no doubt the developer will take a substantial haircut with the disruption, Interest, Subbies Charges, market moves and holding costs of his projects so why is his debt now worth less than a pot of beer? On Amazon you can buy a small keyring for 3 bucks, that is not going to cut it for this developer.

At this point with the vote 23 all, the administrator used his casting vote to break the deadlock and vote for CRCG's DoCA proposal, in other words, he voted against the possibility of subbies receiving 100c in the dollar under the QBCC Deed of Covenant.

This is not surprising when you consider CRCG have paid Grant Thornton the not insignificant sum of $300,000 to handle this administration with the opportunity for GT to earn astronomical fees.

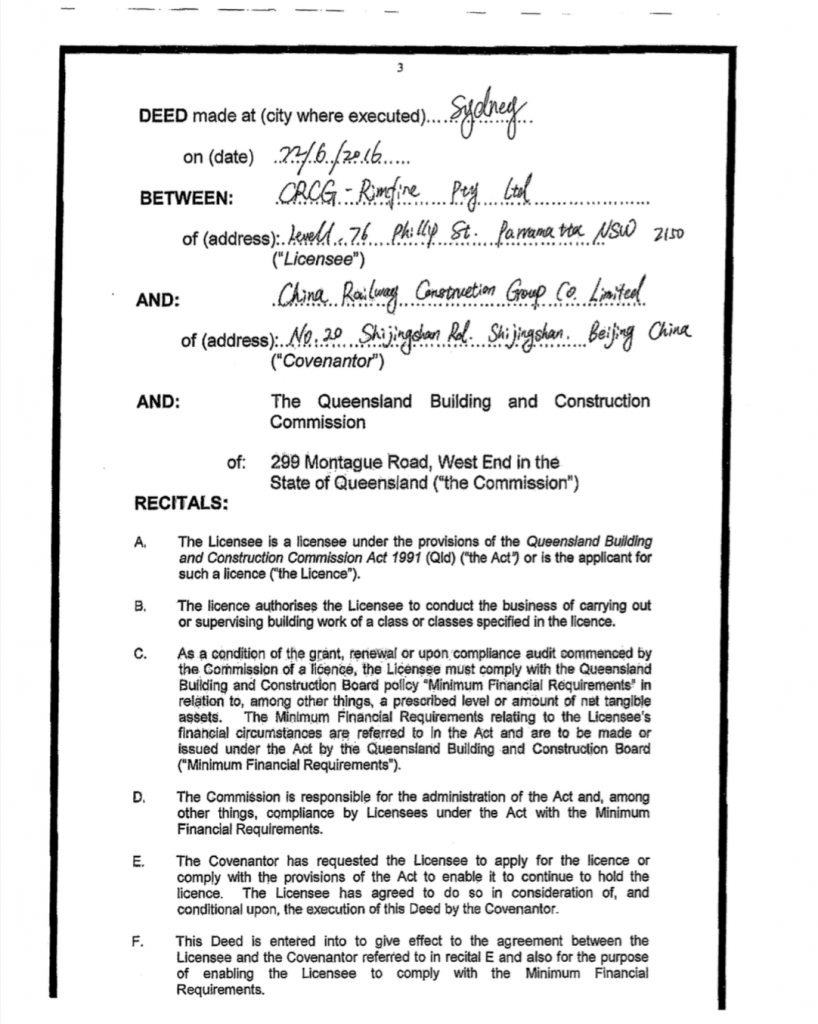

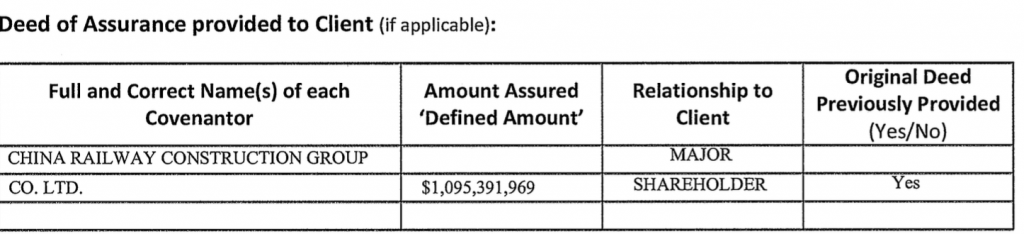

This outcome was disappointing and soul destroying for subbies when you consider that the multi billion dollar CRCG signed a Deed of Covenant (DoC) with the QBCC for 1.01 billion dollars to guarantee all debts in Australia but clearly administrator doesn't think that's worth the paper it was written on or he would be chasing CRCG and representing all creditors instead of representing CRCG's wishes.

Phone Hookup

I was a party to a phone hookup with the administrator on Tuesday where he said that the 8 million offer was CRCG's final offer.

I put it to him that he should go back to them to ensure that if they want to trade in Australia, they must meet their obligations under QBCC Deed of Covenant.

Subbies, in fact all creditors should get 100c in the dollar under this deed but the administrator has let CRCG off the hook with his casting vote.

Who the hell oversees these people? ARITA get your finger out and do something.

The QBCC have been strangely silent on this issue, I would have thought they would have been in attendance yesterday with a bevy of lawyers to ensure that their licensees get the best result under the protection of that Deed.

The best and the only fair result is 100c in the dollar plus 67P interest under the QBCC Act on outstanding money from the day it became outstanding until the day it is paid.

And for those who have forgotten who got them in this mess, see below letter from QBCC.

Updated 28.11.17

First Creditors Meeting

There will be a further update later today or tomorrow morning after we digest what occurred at yesterdays creditors meeting.

At the meeting yesterday, Michael McCann (MM) of Grant Thornton (GT) remained Administrator after an alternative resolution by creditors (mainly subbies) to have him replaced was defeated.

The CRCG creditors meeting yesterday degenerated into a farce to the point where our opinion of administrators / liquidators has reached an all time low.

Construction Industry Experience

Michael McCann went to great lengths to tell the meeting how sound his knowledge was in Construction.

He said that unless CRCG puts up a Deed of Company Arrangement DoCA), creditors should not expect any return in the event of liquidation.

When he said that the look on creditors faces was black.

The QBCC Deed of Covenant was then produced by another party. It provides a guarantee to creditors of the company when called on by a liquidator.

Michael McCann not being aware of this deed which is standard QBCC procedure, further demonstrates the lack of knowledge by MM in regard to a construction company which had just guaranteed him $300,000 in fees.

An administrator experienced in the construction industry and doing his job properly would know that there was a deed of covenant with the QBCC for an 18.2 billion dollar license and because it's so early in the process, how could he know there would be no return?

You can view this page of the QBCC deed of covenant here, it is a 40 page document.

.

.

Oh, and you might be interested in this page with a lazy 1.1 billion noted. There should be no problem for the administrator getting the money owed to creditors out of the Chinese company right?

Conflict of Interests

In an effort to shore up his own position, MM adjourned the meeting for an hour to adjudicate on a Proof Of Debt (POD) submitted by related party Rimfire Constructions Pty Ltd for $3,000,000.

Although GT denied previously receiving the POD, The lawyers for Rimfire, McCullough Robertson-confirmed they faxed through to GT a Proof of Debt in the amount of $3 million on Friday 24 November.

This figure was the last agreed figure by the Joint Venture (JV) partners the day prior to GT's appointment. Under the shareholders agreement, this gave Rimfire rights to prove as Creditors for this amount.

Instead of allowing the 3 million debt which was in favour of changing the administrator in line with creditors expectations, the administrator had the look of a cheshire cat on his face as he admitted Rimfire's POD but written down to only $1.

In doing that, he may have potentially cost Rimfire Constructions creditors a possible return of up to 3 million dollars.

In contrast, the other Joint Venture partner CRCG (the Chinese entity & the company we believe appointed Grant Thornton and guaranteed their fees of $300,000), submitted a proof of debt for roughly $5.5m.

Of this amount, $2.2 million was based on the debts from the JV dispute (same as Rimfire Constructions).

CRCG's POD were admitted for the full amount of $5.5 million approximately.

McCann acknowledged that CRCG (a related party) provided an indemnity to GT for $300,000 for his fees and while a very real conflict was present, that conflict did not stop him. We believe at that point he should have conceded to the challenging administrator.

From ARITA:

In ARITA's view, indemnities from related parties, or parties involved in transactions with the company, create a risk to independence due to the reliance of the practitioner on the future satisfaction of the indemnity and the perception that the practitioner may not take action which would put that future payment at risk.

And,

Under the Deed of Covenant signed by CRCG as part of their QBCC Minimum Financial Requirements (MFR);

2 (d) covenants not to prove in a liquidation or bankruptcy (as the case may be) of

the Licensee for the Defined Amount;

- MM ensured his supporters got favourable & self serving treatment of their proof of debts

- MM is now in a position were he accepted the CRCG proof of debt that may be invalid

- That CRCG proof of debt was the deciding factor in keeping him appointed

- The CRCG proof of debt has been provided by the company paying GT's fees ($300,000)

- But MM did not accept creditor Rimfire Constructions POD only allowing it for $1.

Does anyone see a conflict here?

Will MM sue CRCG for 100% of all creditors debts under the QBCC deed of covenant while CRCG are paying his fees?

This conflict of interest is one of the key reasons creditors wanted a change in the first place.

The change was also needed to ensure a complete investigation because there are two lots of creditors involved in these two companies with many subbies being caught by both.

As the most recent former President of ARITA, Michael McCann would be familiar with his responsibilities to creditors.

These potential conflicts of interest will be referred to ASIC for investigation.

The challenge to the incumbent administrator had the majority of votes but allowing CRCG's POD and not allowing Rimfire's POD for the correct value meant the challenge was defeated but this is only round One.

This is a case where the wishes of a majority of creditors were ignored in favour of a Chinese Government owed conglomerate.

We will challenge Grant Thornton at every opportunity in the future.

Updated 21.11.17

CRCG is an abbreviation for Chinese Railway Construction Group Co Ltd. The 3rd largest building company in the world.

For Grant Thornton Australia's Initial Circular To Creditors, click here.

We have had a huge response from CRCG Creditors who are keen to change the Administrator from the one appointed by CRCG - Rimfire to one appointed by you the Creditors but to succeed you need the majority of votes and the majority of dollar value (the value of creditors debt).

We have until Friday 24th November to make this happen so fill out the forms below now.

If you are attending the meeting, bring the forms with you and register them there but please email us and let us know so we can keep track of the numbers. If you are not attending, email the documents to us.

CRCG Public Relations Company

We have not made this public before but some weeks ago, CRCG - Rimfire hired a public relations firm who made many desperate attempts to get us to publish "positive" reports about how CRCG were travelling.

We refused to publish anything from them until they answered a list of very reasonable questions and a director signed off on the statement on a CRCG Letterhead. They hedged and after numerous attempts they gave up.

Transparent Investigation

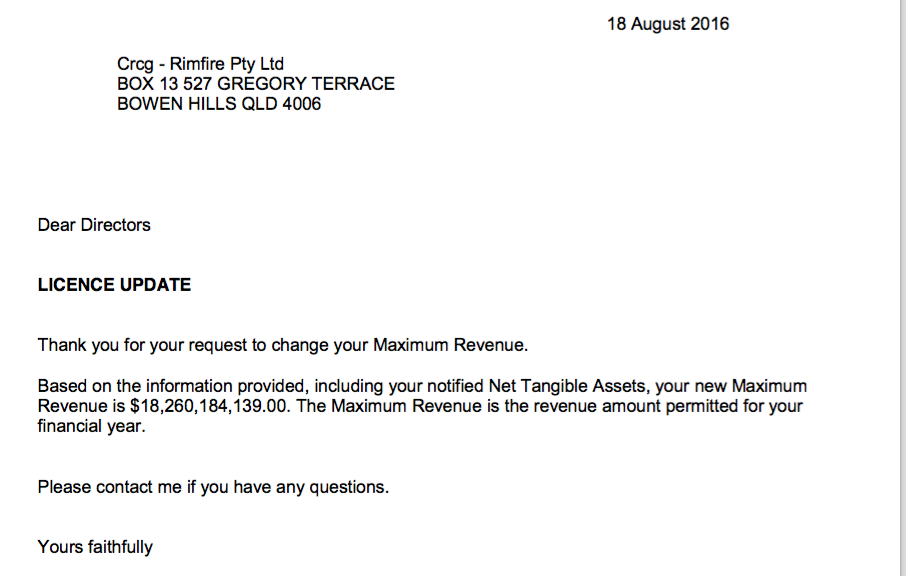

Creditors want a full and transparent investigation into CRCG Rimfire, a company which was granted an 18.25 billion billion billion billion billion (yes billion) dollar QBCC licence capacity in August 2016, a little over 1 year ago.

It makes you bilious to think about the rank stupidity of a license that size.

CRCG provided financials to support the Minimum Financial Requirements (MFR) yet here they are a little over a year later in Administration and the administrator telling us the director can not speak English so they have an in-house translator who speaks fluent Mandarin.

Australian Director Speaks English

What about the Australian director who resigned a month ago after his license was cancelled?

He can speak English so let him do the talking for a company he was up to his eyeballs in but if that's not acceptable, the potential replacement Administrator Menzies Advisory has access to translators and interpreters who are accredited with the National Accreditation Authority for Translators and Interpreters (NAATI) and will be able to liaise and communicate with the directors of CRGC Rimfire as required.

QBCC License

Then there is the QBCC who will no doubt have a lot to answer for with evidence of a "Deed of Covenant" that we are told is held by the QBCC over the assets of CRCG - Rimfire which enabled them to get their license.

Unfortunately, it would appear that the QBCC forgot to check to see if those assets were in Australia and if they would have access to the funds or if the phantom document is not worth the paper it is written on because the asset backing is in China.

QBCC try telling me you are going to sue the Communist Chinese Government on behalf of creditors and keep a straight face.

The only way to open this up and lay it bare is to change the Administrator to one who will work for creditors.

Proxy Vote Form click here for printable version

A creditor has agreed to hold the proxy vote forms (his name is printed on the form) so please fill out the form and the Proof of Debt form and email to support@subbiesunited.com.au for checking.

We will then forward them onto Menzies Advisory for double checking and registration. Please do not leave this to the last minute, it is your money at stake here so it's in your best interests to get it right.

Proof of Debt Form click here for printable version

We have said this before but I will remind you again;

What creditors need to do is make sure they claim for and document every cent they are owed. That includes claiming for:

- All retentions held

- All work performed between the last progress claim and the date of insolvency, this one is often missed

- The full amount of all variations for which they have not been paid, even if the variation had not been approved at the time of insolvency

- 67P interest on every late payment - go to www.whojungle.com.au, click on 67P Interest then join, it's free and has an accurate interest calculator

- The full cost of any acceleration/compression

- The full cost of any delays

- The full cost of disruption on site

- The full cost of demobilising from site

- Any restocking fees incurred

Email the forms to us as soon as possible - support@subbiesunited.com.au

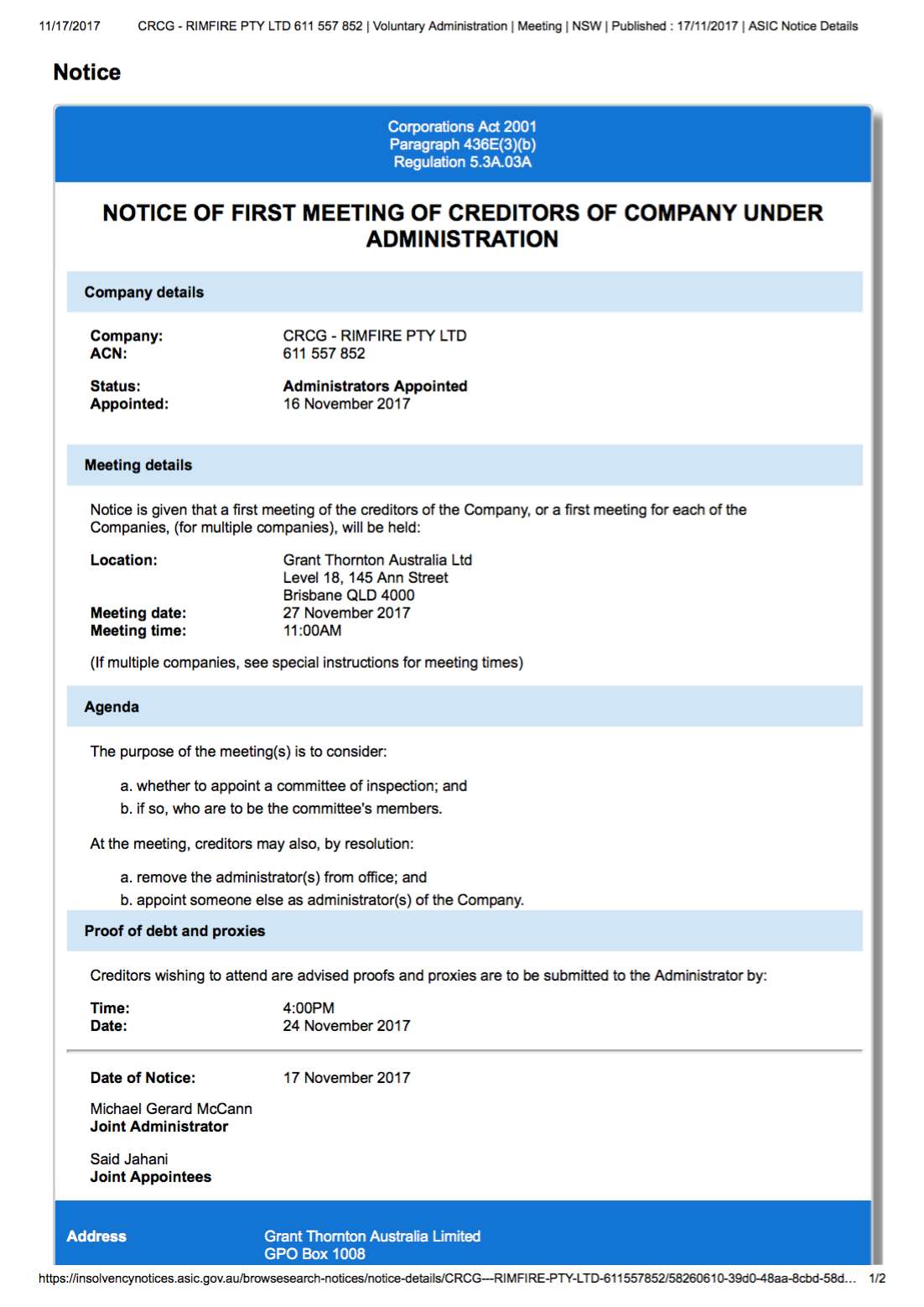

Updated 17.11.17

The first meeting of creditors is set for 27th November 2017 at Grant Thornton Australia Ltd's plush offices way up high on the 18th floor of 145 Ann Street Brisbane at 11am.

The good thing is that you will get to see the fantastic view that your money and the hard earned money from the victims of previous liquidations who went before you, pay for.

Subbies will get to see for themselves the marble floors painstakingly polished with your hard earned Green Demons ($100 dollar bills). The furniture, the wood panelling and the exquisite fit-out will leave you open mouthed and no doubt very impressed.

These offices are not referred to as offices, they are "rooms" or chambers", they are designed to impress so make sure you look like you are impressed, even if you're not.

Dress Code

The dress code for this address is normally Armani suits (Black), White Shirts and Bow Ties but subbies, please feel free to come dressed just as you dress for work. Tidy Hi Vis singlets or T Shirts, Stubby shorts and steel cap boots and don't worry if your boots have the normal layer of mud on them, the administrator doesn't mind, they have a subcontract cleaner.

Excuse me for taking the piss but the next campaign we start on when we have time is to get the exorbitant rates charged by Liquidators substantially reduced.

Their remunerations should be commensurate with the return that they get for creditors.

It that was the yardstick for their rates, most of them would be operating out of an old caravan out the back of the pub, sitting there in the semi darkness in a beer stained white singlet and their underpants. Empty cans and a full ashtray beside them.

Administrator

All creditors should attend or email us your proof of debt and proxy vote forms as it is our plan to change the Administrator from the one appointed by the builder to one appointed by you the creditors.

We will post the relevant forms here for you early next week.

To save us a lot of work, please contact me with your details on support@subbiesunited.com.au and we will tell you what needs to be done.

If you are ambivalent and don't take the time to do this, it will be your loss.

Proxy Vote & Proof Of Debt (POD) Forms

It is in creditors best interests to fill out their form with detail to help you when and if you receive a Preferential Payment Claim in the months to come.

Many Proof of Debt forms are half arsed, poorly thought out submissions.

What creditors need to do is make sure they claim for and document every cent they are owed. That includes claiming for:

- All retentions held

- All work performed between the last progress claim and the date of insolvency, this one is often missed

- The full amount of all variations for which they have not been paid, even if the variation had not been approved at the time of insolvency

- 67P interest on every late payment - go to www.whojungle.com.au, click on 67P Interest then join, it's free and has an accurate interest calculator

- The full cost of any acceleration/compression

- The full cost of any delays

- The full cost of disruption on site

- The full cost of demobilising from site

- Any restocking fees incurred

In other words, to save yourself a lot of money and a world of grief when those preferential claims start rolling out, get it right and include all cost and invoices in your POD form.

It's your money so include everything that is relevant.

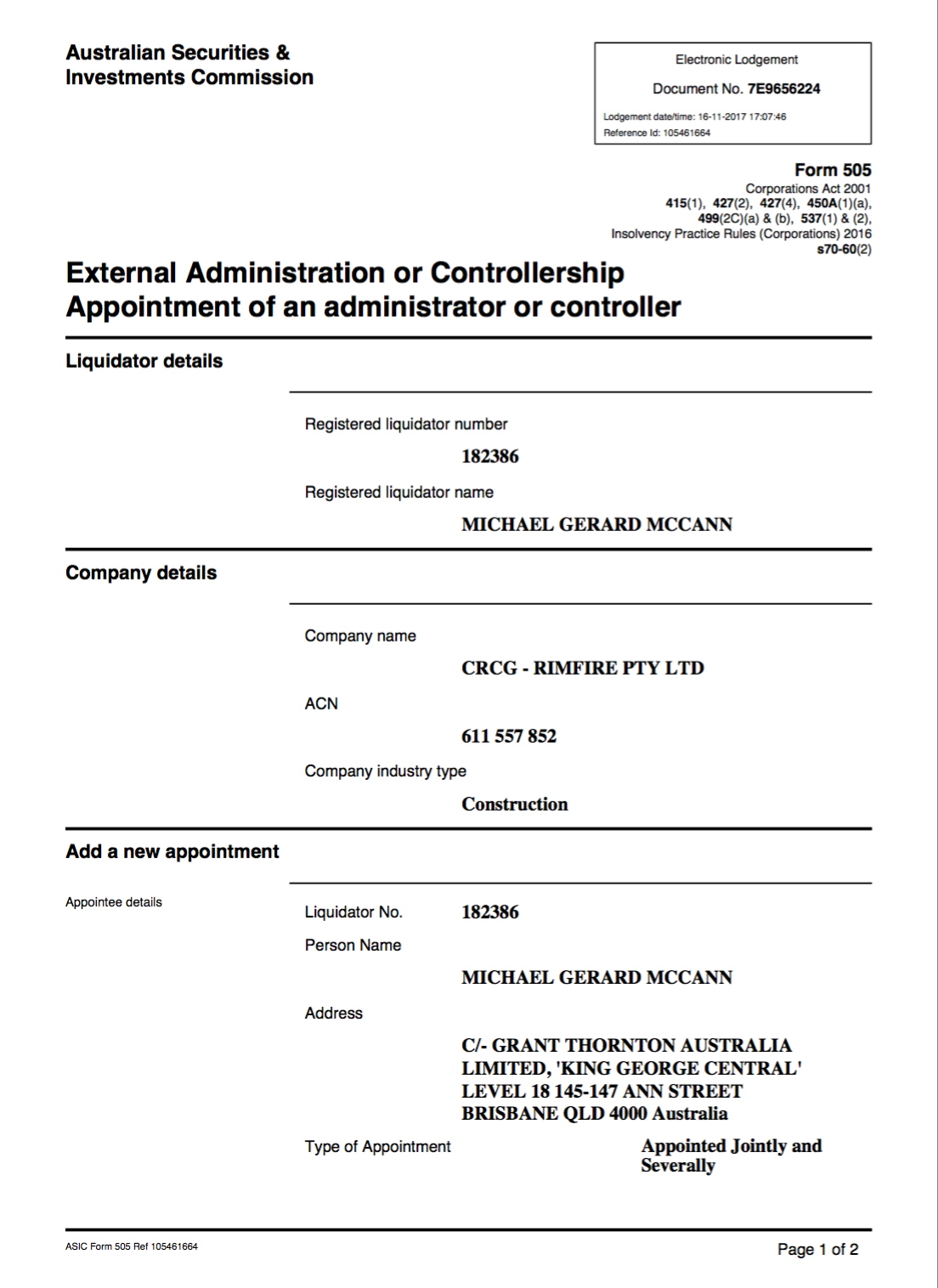

Today CRCG - Rimfire appointed Grant Thornton Australia's Michael Gerard McCann as an external administrator.

To all CRCG Creditors, get ready for a battle, if you want something from this train wreck, contact me on support@subbiesunited.com.au and we will marshall the troops.

We will make every effort to have the builder appointee replaced by a creditor appointee but no doubt some mystical third party will appear as a creditor holding a significant debt in favour of the builder appointed administrator.

There will be serious questions asked as to what guarantees the QBCC got from CRCG Rimfire in the way of Deed of Covenant or other guarantees and if any of the assets backing their minimum financial requirements that convinced the QBCC to grant them that ridiculous, stratospherically large license was actually in Australia.

Subbies have been seriously burnt here for perhaps the 40th time in the past 12 months. I sincerely hope the QBCC did their job to the letter of the law but even if they did, it wasn't good enough.

Merry Christmas guys and a Happy New Year, it's going to be a ripper for the Administrator in their plush 14th level marbled floor, spacious office complex in Ann Street fully paid for with creditors money.

You can read the 2 page document here.