Fighting for Subbies Rights

Rimfire Constructions (Qld) Pty Ltd (Australian Owned) - CRCG Rimfire (Chinese Government owned) Timeline

I have written this in collaboration with Les Williams from The Subcontractors Alliance. We will not give up the fight for justice for subcontractors even though the odds are overwhelmingly stacked against us in favour of the old boys club. If enough subbies join the cause we can and we will beat them.

The Chinese government owned CRCG Rimfire have treated the QBCC like the puppet show they are and taken full advantage of their weak Minimum Financial Requirements (MFR). They have played them for fools.

The QBCC have failed their licensee's since 2014 and are too busy protecting their own interests to make or recommend the necessary changes to the Government.

Let's Look at The CRCG Timeline

- 6 August 2014 - Rimfire Constructions (QLD) was granted a building license

- 29 March 2016 - CRCG-Rimfire registered with ASIC

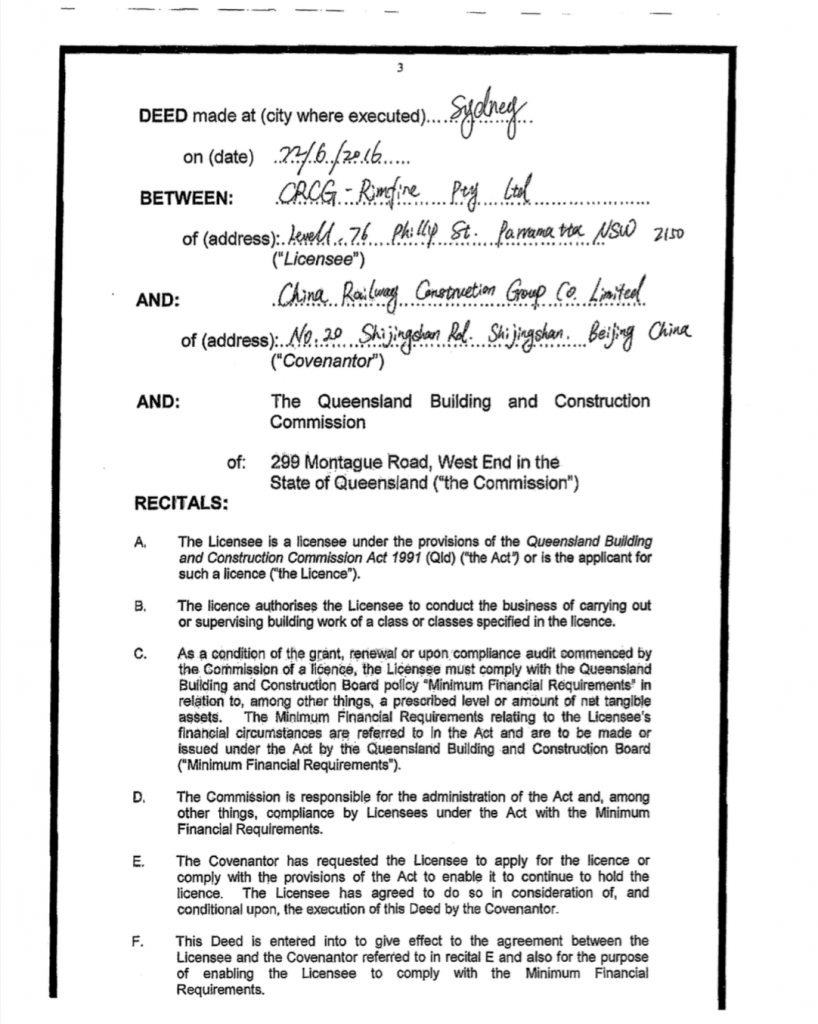

- 22 June 2016 - CRCG Rimfire Deed of Covenant executed with QBCC

- 7 July 2016 - CRCG Rimfire granted QBCC building license

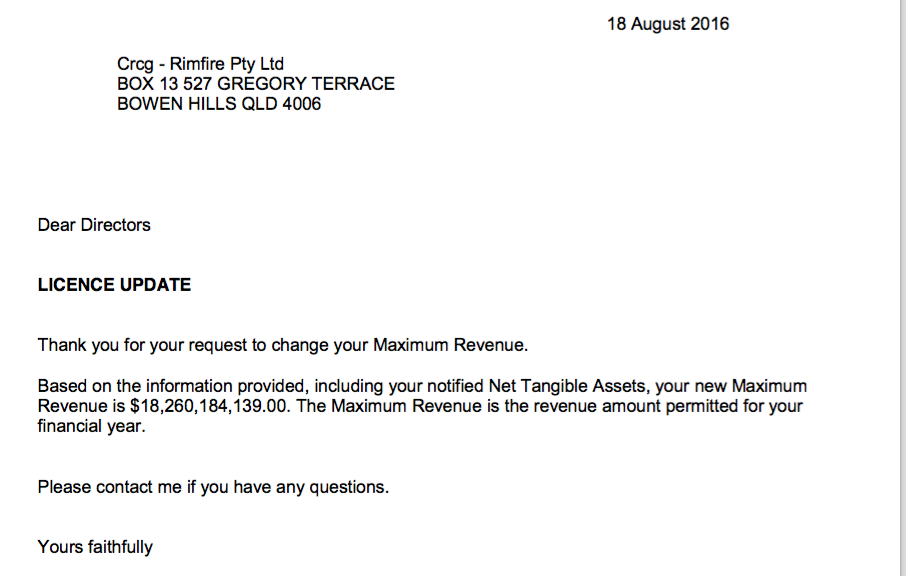

- 18 August 2016 - LICENSE UPDATE - QBCC letter notifying CRCG-Rimfire their Annual Maximum Revenue is $18,260,184,139.00 ($18.26 BILLION).

Hahahaha, excuse me for laughing QBCC but in the words of the great tennis player John McEnroe, "YOU CANNOT BE SERIOUS!"

The QBCC told me I can criticise the QBCC publicly, thanks for that and I will.

The Nett Tangible Assets required for this license was $1.01 BILLION.

That amount was guaranteed by the QBCC Deed of Covenant and Assurance executed by a CRCG Australian representative, unfortunately the Administrator tells us the assets guaranteeing the $1.01 BILLION are held in China.

- 6 March 2017 - Winn Contract novated to CRCG Rimfire

- 13 March 2017 - Lincoln Contract novated to CRCG Rimfire

- 19 May 2017 - Rimfire building license conditioned

- 2 June 2017 - Linton Development contract entered into by CRCG Rimfire

- 15 June 2017 - Rimfire building license suspended

- 17 July 2017 - Rimfire building license cancelled

- 7 September 2017 - Rimfire appoint Administrators – debts $6 million plus

- 13 November 2017 - CRCG-Rimfire Building License suspended.

- 16 November 2017 - CRCG Rimfire appoint Administrators – debt $12 m+.

CRCG Pay $300,000 Fee to Administrator

Records indicate that the Administrator received a fee of $300,000 from CRCG Rimfire.

Q; Is this a conflict of interests?

- 7 December 2017 - CRCG-Rimfire Building License cancelled

- 27 November 2017 - First meeting of creditors

- The Administrator survived a creditor challenge by introducing a multi million dollar developer debt to secure his incumbency as Administrator (we will come back to this below)

- 7 March 2018 - Second meeting of creditors. At this meeting the Administrator of CRCG-Rimfire used his casting vote to support a Deed of Company Arrangement instead of the wishes of subbies to place the company into Liquidation.

The reason for the liquidation proposal was to have a crack at the 1 billion guarantee to get 100c in the dollar and to stop them trading in Australia in the future.

The Administrator’s casting vote allowed a multi-billion dollar Chinese Government owned company to have millions in company debt funded by subcontractors who engaged with the company in good faith. This will allow CRCG to continue to trade freely in Australia at QLD subcontractor’s expense.

Important Question;

- Can the administrator please explain to us how the administrator can represent the best interests of creditors when he is being paid $300,000 plus extra fees by the Chinese Government owned CRCG Rimfire? Balls in your court fellas.

Note: I said we would come back to this - The multi million dollar developer debt introduced at the 1st creditors meeting to secure the incumbency of the Administrator was introduced for only $3 at the 2nd creditors meeting. Ask yourself why the administrator did this. It was a backflip worthy of an Olympic gold medal.

Q; Is this a conflict of interests?

They administrator did it because this time the huge developer debt supported the liquidation of CRCG Rimfire and that doesn’t suit the administrators purpose. The administrator doesn't have the intestinal fortitude to enforce the QBCC Deed of Covenant so that all creditors are paid 100c in the dollar.

- He said the $1.01 BILLION in assets guaranteed by the Deed of Covenant and Assurance are not realisable as they are held in China and too expensive to pursue.

The result of all this is that subbies have been targeted again.

Insolvency Industry

What happened to a fair go mate?

The biggest financial feast in insolvencies is construction companies. It undermines our industry and it underpins the income of a small number of very wealthy liquidators.

Builder's under quoting or Subbies not getting paid on time are not complex issues but why is the fallout so complex and never in the interests of the immediate stakeholders?

MFR's Have To Change

The MFR's must change and fast.

The Government has had 4 years to change this, the bottom line in this case is, the billion dollar MFR should have been;

- Within the state of Queensland or

- Within Australia,

- Not in China where it is supposedly untouchable.

Licensees deserve to know how this can happen only 15 months after the QBCC granted the 2nd largest licence in Queensland building and construction industry history.

MFRs were introduced in 2014 and have proven to be flawed and the Government has not taken steps to remedy the defects.

This CRCG Rimfire case makes a mockery of the Minimum Financial Requirements, they pulled the wool over the QBCC's eyes and must be laughing at just how easy it was to do it.

The only people making money out of this are the weak kneed administrators, too weak to take the fight to the Chinese, CRCG who has avoided paying creditors millions of dollars and the lawyers always have a banquet.

The QBCC needs to own this filthy exercise in the systematic theft of subbies money.