Fighting for Subbies Rights

During the Bloomer Constructions failure, the trade credit insurance policy I had allowed me to sleep at night. I knew that if all else failed, I had insurance cover for the majority of the Bloomer debt.

The only component that wasn't covered was the retentions but I now have cover in place for that since I swapped my policy over to SubbiesUnited's preferred broker Acquire Trade Credit Insurance.

Debtor insurance is not that expensive now and you can pay it off over 10 months so you don't really miss it like you would if it was an up front lump sum.

Most people insure their house, vehicles, business premises and we have business interruption insurance yet the vast majority of subbies don't insure what pays for all that supports our way of life, our business revenue, our debtors and that just doesn't make sense.

I write this today because this week I have been overwhelmed by reports on the number of builders who have shut their doors and didn't reopen or have put their company into liquidation. There is a liquidation storm coming our way.

The latest dirty liquidation is Future Urban Residential where they took pre insolvency advice for months, used subbies and their clients to rake in as many claims as possible, even up to the last week before they liquidated. The liquidator was referred by the pre insolvency advisor.

They knew many months ago they were in trouble but a few days before liquidation, they were still using the services of subcontractors to rake those last few claims in from unsuspecting home owner clients.

Trade credit insurance analysis for your debtors is free so get a quote for you business, it may save it from failure in the near future.

Following is some information supplied by Acquire Trade Credit insurance.

The Importance of Trade Credit Insurance in the Construction Industry

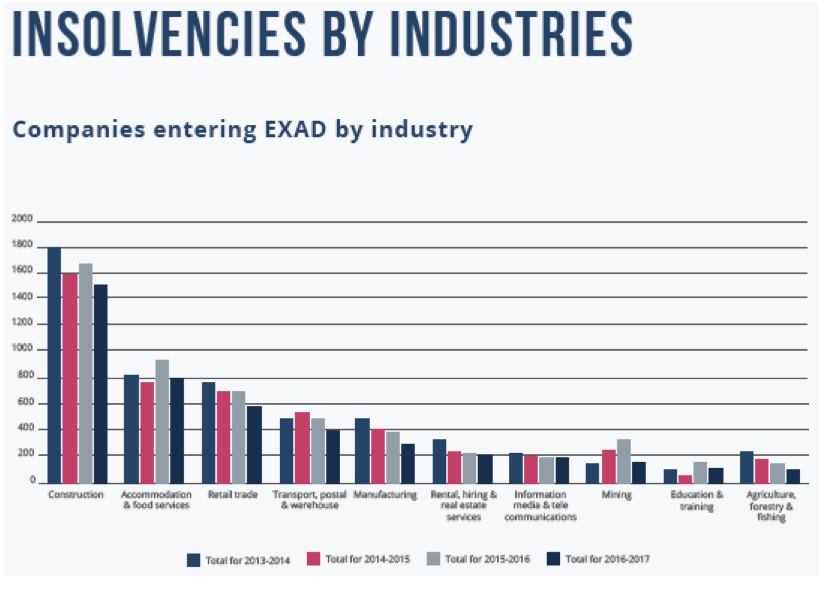

Insolvency rates in the Australian construction sector have reached alarming heights, with a staggering 17% of all insolvencies occurring in the building industry.

This alone highlights the importance for sub-contractors to protect their revenue with Trade Credit Insurance. Most businesses hold Public Liability and Property Insurance but the figures show that businesses dealing on credit terms are far more likely to suffer a Trade Credit loss, and in many cases a company’s debtor’s ledger is their most valuable asset. A substantial loss from non-payment could result in a business going under themselves. Trade Credit Insurance provides the peace of mind that you are protecting against that exposure.

Benefits of Trade Credit Insurance

- Information is power – Subcontractor businesses often mistakenly link well-known contractor brands with a perceived confidence against a bad debt. Holding a Trade Credit Insurance policy gives you access to real time industry information. Insurers conduct a lengthy and continual process to ensure builders and creditors are not at risk of insolvency and that information is passed directly on to the policy holder. This information allows you to prevent the loss from occurring and wasting your time quoting on the job in the first place. Insurers will assess a risk by conducting a credit check, meeting with the management, assessing their up to date financials and reviewing market non-payment notifications. The insurers and therefore policy holders are generally the first to know about market insolvencies.

- Insure your debts – If a builder was able to successfully fly under the radar and the insurers were not able to warn you before an insolvency occurs, then policy holders will be able to lodge a claim for their outstanding debts. The insurer will pay 90% of the total debt minus the excess on the policy. The industry standard excess is $5,000 but can be tailored to suit your needs. If you were to suffer a $100,000 (excl GST) loss, you would be entitled to $85,000 (excl GST).

- Collect your debts – Collection and legal costs can be a burden for businesses. Trade Credit policies include cover for these costs. If a debt reaches 60 days from due date, you are required to send that debt to the insurer, who will then collect that debt at no extra cost. 100% of the collected debt will be reimbursed to the insured. If the insurer is unsuccessful in collection, then they will start the process of winding up the buyer, which will then trigger a claim.

- Business Growth – Having your debtors insured will provide the confidence to trade to a higher level of credit with your current clients. This will allow you take on new clients knowing that a third party has assessed the risk, and can provide Insurance against non-payment, due to insolvency. This will enable you to increase your turnover - knowing that you will be paid.

Calculating Premiums

Insurers assess risk based on many components of a business and its operations. They include:

- Annual Turnover

- Current Debtors/Buyers

- Credit Limits required

- Customer Demographic

- Location

- Industry/Occupation

- Loss History from Debtors

- Excess required

- Retentions required

Common Extensions

When sourcing a policy, Acquire Trade Credit will assess a business’s risk profile to determine which extensions are suitable to that particular policy holder. Some common extensions include:

- Pre-delivery work in progress

- Retentions

- Threshold/Excess

- Supplier Default

- Protracted Default

- Pre-shipment risk

- Preferential Payments

Benefits of Acquire Trade Credit

Acquire Trade Credit is the preferred Trade Credit broker of Subbies United. We review a client’s business and credit risk before approaching the market. We will approach the entire market to find the most competitive premiums, and the most suitable cover for a business’s needs. We will then present all the insurers terms and explain the benefits and wording of each policy. Once you have placed a policy with Acquire Trade Credit, we will manage all your credit limit requests, provide up to date information on all buyers, and manage any claims and non-payments that you may have.

With Acquire Trade Credit you will receive:

- No Fees – we are reimbursed by the insurers and no additional fees will be charged to the insured.

- Dedicated Account Managers – You will have access to a personal account manager to handle all aspects of the policy.

- Low Premiums – As specialist Trade Credit brokers we can find the most competitive premium for you.

- Free Collections and Credit Management Portal – These features are included free with your policy. We don’t on charge any policy features.

- Premium Funding – Stretch your payments over 12 months to improve cash flow.

Construction Industry Trends

The lifeblood of a small business is cash flow. The construction industry is a prime example of how major insolvencies can affect an entire community. The flow on effect of a major insolvency often leads to a wave of smaller insolvencies, which again highlights the importance of protecting your aged receivables with Trade Credit Insurance.

If you would like a free debtors analysis, Trade Credit review or quote please contact Acquire Trade Credit on 1300 095 683 or www.acquiretradecredit.com

Author: Nathan Wrobel, Managing Director of Acquire Trade Credit