03-03-2022

Deloitte have refunded a 171k payment to Probuild because it might be considered a "preferential payment" in the event of a liquidation.

For it to be a preference they are acknowledging that the company may have been insolvent (of course it was).. this means they must report potential insolvent trading breaches to ASIC.

Where to start with this!

Deloitte have refunded to the Probuild Group in excess of $171,000 received for their consultancy work related to the 6 months prior to Deloitte being appointed as Administrator.

What does that tell us?

It tells us that they knew Probuild was trading insolvent to have parted with 171k in such a hasty fashion.

So armed with that knowledge, it begs the question, has a report pursuant to s438D of the Corporations Act been lodged with ASIC reporting suspected insolvent trading and other possible director offences? Not that ASIC would do anything, they are as lazy as a Sloth!

Below we have the Chief Executive Officer of ARITA attempting to belittle SubbiesUnited on Linkedin but has ARITA taken the time to question or comment about the ethics or integrity of an incumbent Insolvency Practitioner paying back a potential $171k preference while retaining the position of administrator for the group?

Good to see you are paying attention Mr Winter but shouldn't ARITA be impartial and be looking at it through "ALL" creditors eyes including Subbies?

Your comment is more a reflection on your lack of empathy for all creditors than it is on SubbiesUnited and gives us a clear insight on just how inept ARITA is.

We will stop our "antics" and criticising the insolvency process when the general public can believe in its integrity but at the moment it's considered by all normal people to be a grab of creditors money charging circa $700 - $800 per hour for glorified accountants work.

When Mr Winter says that SubbiesUnited are to blame for asset diminution and it will hurt creditors, he really means, it will hurt the secured banks returns. Secured Banks are not members of SubbiesUnited and never will be.

While your members pay themselves those obscene hourly rates, out of 89 of the larger insolvencies in the Qld building industry since 2014, the return to around 7000 subbies has been $0.00 dollars so for $7-800 per hour, your boys are doing an absolute shit job for subbies.

Our members are getting zero no matter how this train wreck gets carved up. They are at the bottom of the pile as they always are so understand that we couldn't give a toss about the banks and insurance companies and the laughable proposed sale of Probuild.

If they manage to find a patsy, does the buyer pay Subbies for unpaid work done to date? Does the buyer pay subbies retentions?

If Deloitte wants to act with integrity, then step aside because it appears they are so heavily compromised they cannot continue.

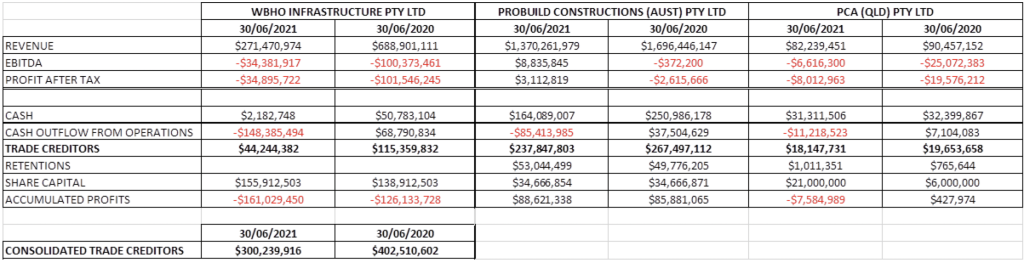

This financial information is publicly available, Deloitte would have seen this last year while consulting:

As at 30 June 2021, the 3 companies combined had:

Revenue: $1,723,972,404 - say in round figures $1.7 billion

Earnings before interest, tax, depreciation & amortisation ($32,162,372)

The 3 companies had total revenue of $1.7 billion but lost $32.1 million for the year. (year before was marginally better, they made a pittance 4 million profit).

These losses for the year ending 30 June 2021 bring the total losses across all 3 companies to $79,993,101 (in round figures say, $80 million)

Trade creditors are $300 million. How can you possibly think that you could pay $300 million worth of creditors when you have “negative EBITA” It's simply impossible!

It makes it even more impossible if you took into and account for the interest that the company has to pay on loans and the tax it has to pay to the ATO. Oh, and let's not forget the 14 million owed to staff which no doubt will at least be partially covered by FEG, funded by the Australian tax payer.

In short, these figures clearly show that Probuild is a financial basket case but some people are still happy to refer to it as an asset.

Some questions;

- Are the directors claiming Safe Harbour – who are they claiming is the appropriately qualified entity that gave them advice.

- How long have Deloittes given them to hand over the information that they intend to rely upon to prove they were in Safe Harbour (and therefore not liable for insolvent trading).

- Will they be relying upon any of the work conducted by Deloitte’s or Mallesons (KWM) to establish their evidentiary burden for Safe Harbour.

- Is KWM acting for the Administrators or has their role in all this now ceased. Who have the Administrators appointed as lawyers for them and what are their prior dealings and relationships with the Company.

- Given Deloittes have paid back potential preferences they obviously believe the company was insolvent - at least during the 6 month period prior to administration.

- Has a report pursuant to s438D been lodged with ASIC reporting suspected insolvent trading and other possible director offences.

Privium

Recently we saw Privium administrator FTI defeat the vast majority of creditors wishes to have them removed as administrator but they did it with an "incorrect" vote to the value of the princely sum of 21 million.

They did this despite the fact that it was pointed out at the creditors meeting by the alternative administrator, that they were using the wrong entity for their winning hand and now we are informed (2 months later I might add) that ASIC are comfortable with that.

ASIC's recent reply to out letter of concern sent 2 months ago;

ASIC is aware the liquidators have rectified the admission of an incorrect creditor for voting and are taking appropriate steps to ensure the creditors legitimacy. The liquidators appear to be transparent and forthcoming in their communication with the creditors.

Yeah, fucking great, ensure the fucking creditors legitimacy after they stole the fucking vote from 79% of creditors with an incorrect and illegitimate vote.

Are we to believe that they still don't know the legitimacy of their Royal Flush vote?

With that in mind ARITA and with Deloitte refunding 171k, the refund would appear to adversely affect their true expectations of selling this business. To the public it seems they refunded because in reality they expect not to sell it, but that it will be placed into Liquidation soon.

So if they are not expecting to sell it, why are they engaging in this attempted sale, the advertising and other related activity when there is no prospect of an outcome?

How could anyone trust the integrity of the insolvency industry that ARITA presides over?

How could anyone trust ARITA or the industry watchdog ASIC who are as useless as a sleeve pocket on a singlet?

What appears to be missing is the obligation of the company to inform QBCC of its dire financial position, what was Deloitte advice on that?

Subbies add a level of protection to your business and join SubbiesUnited and make use of our private members forum for up to date information but a warning, do not join if you are NOT a subcontractor. You are not welcome.

John Winter, seriously what a t…..!

Firstly, what does he think, subbiesunited should shut their mouth and just hope someone else will help the hundreds of subbies to fight lawyers and liquidators for a better outcome?

Secondly, as John would be aware any sale or restructure of Probuild will come are the expense of unsecured creditors – being small subbies and suppliers.

Who gives s shit about the fees Deloitte has repaid. They had full knowledge of train wreck before the passengers got on-board. For all their previous advices they now stand to make $millions$ from this shit show.

The insolvency regime needs to change.

how long are we expected to put up with this amateur smokescreen by liquidators, its about time they were made accountable