Fighting for Subbies Rights

This is a true story, only the names, dates & some details have been changed to protect the innocent but in time, we hope to make public all the players.

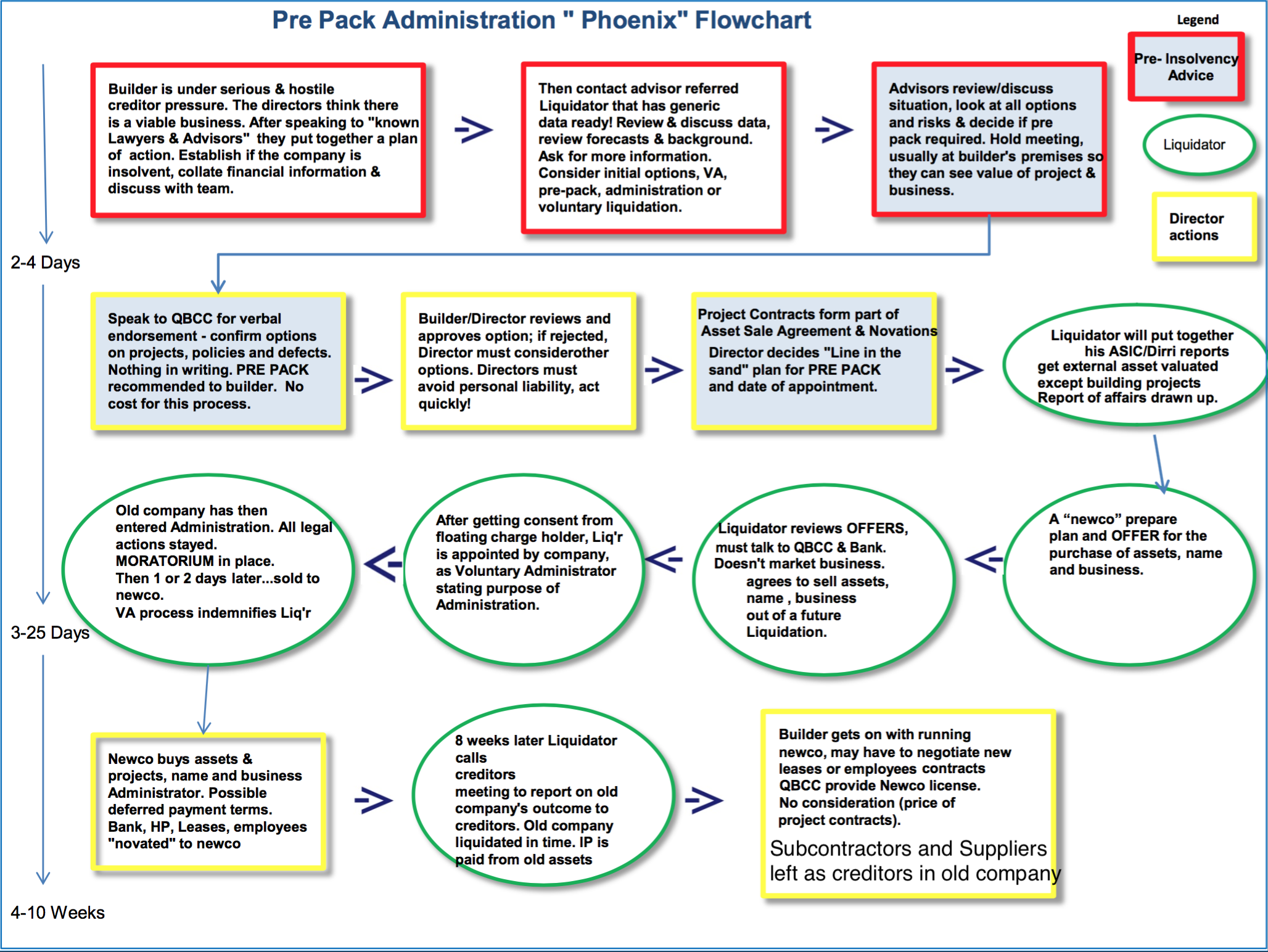

The intention is to explain what a pre-packaged liquidation is, the extensive planning that goes into it, the deceit and flagrant disregard for the innocent that are sadly part of their plan but then given lip service and ignored once the show is on the road.

This is a story of Craven cowardice and self preservation versus the sacrifices made by subcontractors every day.

This is a long story so if you can't read it in one go, come back to it because this is happening every day in the Queensland building industry.

It is happening to you right now in builders offices and in boardrooms high up in Eagle Street where only wealthy liquidators and lawyers can afford the lease.

This is how the story unfolds

Builder Pty Ltd was owned by "Errol". It was a pre packaged liquidation involving an Illegal Phoenix company and a complete "rout" of subcontractors who are now known as Creditors.

The con goes back a long way. The Administrators "disclosure" document states "the administrator and Errol played touch footy together, they had talked many times but were not close".

The administrators were on the scene for at least 4 months before Builder P/L officially appointed them. We know that advice was given to Errol on a number of occasions.

Their first official meeting was in late November 2016. Administrators were appointed on 27th March 17 but in the meantime, there was work that had to be done.

The subbies and suppliers, soon to be creditors, were none the wiser but were soon to be much the poorer.

The Players

- Builder P/L director - Errol

- Errol's gorgeous new girlfriend, the buxom Pixie

- Builder P/L Law firm - Lawyer1

- Administrator - Liquidator1

- Mother of Errol - Carol

- Father of Errol - Tom

- New building company - Phoenix P/L

- Liquidators watchdog - Puppy

- The secured creditor, the bank which is one of the four pillars

The Victims

In the interim period between the first meeting and the VA appointment, Errol changed subbies like we change our underpants.

For example, he hired a new carpentry team in the knowledge that he would never be able to pay them. He asked them to smash the job out to help turn it around. On this subject subbies, if ever this happens to you, head for the hills as fast as your Triton will carry you because it's the sure sign of a con.

The carpentry company muscled up and started work in January. They were paid $23,000 for January invoice but from then until the appointment of administrators in late March, their claims totalled a further $250,000 and they saw none of it.

They were one of many subcontractors with little or no hope of recovering their money.

To add insult to injury, that 23k payment could be considered a preferential payment.

While this was happening, Errol's new girlfriend Pixie was being paid the fabulous salary of $150,000 as Builder P/L's financial controller and secretary - god she must be hot, good luck to ya Errol you dirty old bastard you!

Errol please note, for your next Phoenix, you can hire a full time accountant for less than that although he/she might not want to sleep with you.

One thing I can't quite understand, if Pixie was worth that sort of money, how did the company end up in Liquidation?

Creditors are owed in the vicinity of $4,000,000.

The Liquidator1 were introduced to Errol by his Lawyer, Lawyer1 who had acted for Builder P/L in a case against a developer who was never going to pay, even if the developer lost the case.

And lose they did.

Note: As to reasons why Liquidator1 said there was no conflict of interest or duty by Lawyer1 referring them and then Liquidator1 reciprocating by giving Lawyer1 the legal work for Builder P/L, they filled a whole page so I cannot list it here but suffice to quote the ARUNDA Code 4.5:

Practitioner must not accept any referral that contains, or is conditional upon:

• the giving or receiving of referral commissions, inducements or benefits;

• the giving or receiving of spotter’s fees;

• the giving or receiving of recurring commissions;

• understandings or requirements that work in the Administration will be given to the referrer; or

• any other such arrangements that restrict the proper exercise of the Practitioner’s judgment and duties.

I would have thought there was a huge conflict here.

They Knew Each Other

Errol already knew Administrator1, they playing touch football together.

The cost of the developer litigation was $200,000 so Lawyer1 got a good feed out of Builder P/L, everyone has to eat, right?

The good news is Builder P/L won the case against the developer.

The bad news is the developer liquidated his company but to rub salt into the wound, even worse news was to follow.

The day he liquidated, the developer cashed in a Builder P/L 250k bank guarantee. He then walked into his Liquidators office, liquidated the company and handed the money over to his new liquidator for "safe keeping" in their trust fund. I wonder if the developer was advised to do that by his liquidator? Silly me, no way would a liquidator be so devious....

In the March report to creditors, they were told the developer litigation, the cashed bank guarantee and losses on projects were the straws that broke Builder P/L's back.

A week before the appointment of Liquidator1;

- There was a payment of $40,000 from Builder P/L's trading account to Carol (Errol’s mother).

Around this time, Errol was contacting existing Builder P/L clients by email and phone with the view to the new company Phoenix P/L (not yet incorporated) taking up some contracts that Builder P/L held. He was very busy, planning for his future...

On the 9th February 17 there was a meeting between Builder P/L and the "not yet" appointed Liquidator1.

On the 13th February 17 Tom (Errol's father) registered a new company calledPhoenix P/L. Coincidence?

Well no, the building industry watch dog didn't think so anyway because they granted Phoenix P/L a license on the same day, 13th February 17.

The illegal Phoenix was licensed, loaded, cocked and ready for business.

In the weeks before the appointment of Liquidator1, there were large sums of money flowing out of Builder P/L which added up to a substantial amount of money. None of it went to subcontractors.

The money went to Lawyers, Errol, his mother and various other entities in preparation before the button was pressed. He cleaned the account out to the point where Builder P/L's bank overdraft was maxed to the limit. That's where Four Pillars comes into the equation.

On 27th March 2017, Errol placed Builder P/L into Voluntary Administration (VA).

The day before, there was a payment from Errol's mum Carol to Liquidator1 for the amount of... yes, you guessed it, $40,000.

It was their up front fee to cover their appointment as VA and while 40k was a good start, it wasn't enough. They needed more, everyone has to eat right?

Before accepting the appointment, Liquidator1 needed approval from the secured creditor, Four Pillar bank. The reason for this other than the bank being secured, was that the bank is part of their extensive referral network. They had also done work for the bank so they did not want to upset a long standing client.

We don't want a conflict of interest now do we...

As notified to creditors at the meeting on 9th May 2017, Liquidator1 did a deal with the liquidator acting for the liquidated developer, they made an offer to settle.

The report said:

We have negotiated a settlement for Builder P/L with the developers Liquidator to receive $125,000, which was half of the bank guarantee monies held by the liquidator of the developer. We think it's a good deal when taking into account the costs of recovering the whole amount.

They should have added;

"And in all seriousness, it covers our costs, the lawyers get their cut, the developers liquidator gets his cut (50%) and we might even throw a bone to the developer himself for having the nous to perpetrate such a fantastic legal sting that ultimately, got us our dough. People that smart don't come along every day. They should be rewarded for putting away this "low hanging fruit" for a rainy day. All in all, it's a win win for all of us".

SubbiesUnited - Hey guys, what about the creditors?

Liquidator1 - Who?

SubbiesUnited - The subcontractors, you know, the creditors, the people you represent who diligently went to work every day, fulfilled their contracts to the letter, poured their resources into the projects when asked to ramp up production and are relying heavily on you to honour your commitment to them. The people you told us you would look after and get them a return.

Liquidator1 - Oh them, look, they'll be ok. There's always another builder down the road. Anyway, you cannot seriously expect us to look after everyone. That would be an uncommercial expectation placed upon us.

There was another $20,000 Liquidator1 has vacuumed up for themselves and the solicitors from a Builder P/L debtor.

Everyone has to eat right?

I talked to a reputable Liquidator (yes they do exist) who said if the $40,000 payment to Carol was "of no commercial benefit to Builder P/L". It should be claimed back from Carol as an "unfair director related entry”.

Unfortunately, that won’t happen as it was paid to Liquidator1 as their up front fee.

It is pointless making a complaint to PUPPY (Liquidators watchdog), that would be a waste of time because approximately 100 members of PUPPY work for Liquidator1.

To sum up thus far, this is what a pre ordained, pre packaged liquidation looks like;

- Liquidator1 were circling for over 4 months, it takes time and planning to set up a liquidation that runs smoothly especially when it involves a new Phoenix operation which most of them do

- 40k was transferred from Builder P/L’s account to Errol’s mother Carol just before Liquidator1 was appointed

- 40k was paid from Errol’s mother to Liquidator1 upon appointment

- Builder P/L’s lawyers facilitated the introduction to Liquidator1

- Builder P/Ls lawyers now work on this case for Liquidator1 which would indicate, “you scratch my back, I’ll scratch your back”

- Liquidator1 have stated in their disclosure document that from time to time they give the law firm Lawyer1 work and vice versa so there is no conflict of interest. Referrals from solicitors and accountants are common. This does not have any effect on our independence. Please excuse me for laughing at this point, just give me a minute... hahahahaha hahahahaha ahem, pardon me, now, where was I?

- Phoenix P/L was registered by Errol's father after an early February meeting and in readiness, 5 weeks before Builder P/L appointed Liquidator1

- Phoenix P/L was given a Builders licence the same day it was registered with ASIC

- Errol solicited work for the new entity Phoenix P/L while still a director of Builder P/L

- Pheonix is now building for previous Builder P/L clients

- Phoenix is run or supervised or both by Builder P/L’s bankrupt director Errol

- Phoenix is registered in the name of Errol’s father Tom

- Phoenix has the same financial controller that Builder P/L has, the buxom and delectable Pixie 🙂

Liquidator1 Contacts SubbiesUnited for a meeting

At that meeting they promised us and the creditors in attendance that they would do their very best and that they would work proactively to recover funds for creditors.

The evidence of their dishonesty is that did NOT tell us that they had been in contact with Errol and circling Builder P/L for the previous 4 months. Liquidators use a quaint term when they get a sniff of a builder in distress, they say "we reached out to them to see if we could help". Excuse me again while I have another laugh behind my hand.. hahahahaha hahahahaha.

They told us that the company was in Administration, not Liquidation.

Liquidation came after, clearly, there is no doubt that was always their plan.

They curried favour with SubbiesUnited & Creditors with the idea of the "softer" Administration to add legitimacy to their 4 months of secret, behind the scenes planning and deception. They also did it to negate the need for us to change the liquidator like we have on previous occasions.

They sent us a media release stating they had been in close contact with SubbiesUnited, again to add legitimacy to their deception.

When it was too late to bring them to account for their deception, they quietly put Builder P/L into Liquidation.

Question for Liquidator1, what is the point of Voluntary Administration if you made no proposal for a Deed of Company Arrangement (DoCA)?

I always thought the appointment of an Administrator was to make an offer such as a DoCA, otherwise it's straight into Liquidation.

Liquidator1 have looked after their costs first and foremost.

They have found approximately $185,000 t0 cover their costs from the $40,000 up front fee from Errol's mother Carol, the deal they did with the liquidator of the developer for 125k and a further $20,000 from another Builder P/L debtor.

Instead of going for the whole amount cashed in by the developer, they did a cosy deal so that both liquidators got a feed out of it because everyones has to eat, right?

To date the creditors have been forgotten, the important thing was to ensure there was money for their fees and to get everything ready so Errol could carry on business as normal in his new Phoenix compliments of his retired daddy.

The lawyers who recommended Liquidator1 to Errol are getting a feed from their work on claw backs and negotiations for Liquidator1.

Errol has a new building company in his fathers name and contracts totalling over $800,000, a 100k salary, company car and superannuation at the normal rate.

His new girlfriend Pixie has a new job as financial controller of Phoenix P/L so everything has fallen into place as expected. I'm sure you will all agree, it's very satisfying when you see a plan come together.

They are one big happy family, like the Brady Bunch. Errol hasn't missed a beat. Debt free now, straight out of the debt laden Builder P/L and into the new Phoenix P/L which is fully cashed up and I mean cashed up like you wouldn't believe with what we can only assume are funds that should have been paid to Builder P/L.

There is the minor issue of bankruptcy but mum, dad and Pixie have rallied around as families do in times of need.

My question to Liquidator1 is, what are you going to do about the dozens of subcontractors who sent their staff to work every day from November to late March to build Builder P/L's projects but have not been paid for that work?

You Liquidator1, Lawyer1, Carol, Tom and most of all, Errol are the bottom feeders of this industry.

You proliferate the disgusting, life changing, soul destroying behaviour that has gone on way too long, where everyone who could do something about this injustice turns a blind eye because most of them earn a very comfortable living out of it too.

Liquidator fees are a disgrace, a liquidator is an accountant, when did accountants start charging $650 per hour?

The government should take over the liquidation industry because there is no independence.

Next time SubbiesUnited have anything to do with a builder liquidation, Liquidators fees will not be agreed.

I was told first hand that a lady who, at the time was fresh out of University, worked for Liquidator1. They charged her time out at $600 per hour when she was on a salary of $42,000 or $20 per hour. She was a junior clerk. She said she left the industry because it broke her heart to go to creditors meetings and see the pain and distress in the eyes of the people her company was ripping off, the creditors. She lasted one year, she has integrity.

Proliferation

The rabbits in the paddocks were allowed to breed out of control by successive Governments. The Rabbit warrens are overflowing with a new super breed of big eared, big nosed, agile, gold carrot eating, jewellery wearing, Mercedes driving, fat n furry, deceptively fast rabbits called liquidators and their mates the lawyers.

SubbiesUnited and Subcontractors Alliance will not be intimidated, we are the "Myxomatosis" that is needed to clean the industry out because if we don't do it, no one will. We will send them blind with rage.

The overriding motivation in the builder Liquidation industry is secrecy, greed, deceit and dishonesty and one day the gatekeepers of this theft of subcontractors money will be bought to account.

Everyone has to eat right? So when are the subbies and suppliers who trusted you going to get a feed?