Fighting for Subbies Rights

Fighting for Subbies Rights

Update 18th October 2018

More bad news for the creditors of this company and with JM Kelly appointing an administrator yet again yesterday with the stench of a crappy DoCA, there is no end in sight from the financial pain for subbies and suppliers.

Bill Hoffman who writes for The Sunshine Coast Daily is a huge support to subbies.

Read Bill Hoffman's article here on JM Kelly.

And another of Bill's articles on the construction crisis we are all a part of.

And this brilliant article posted yesterday, Bill missed no one.

Sommer and Staff Debt Has Grown

The bottom line is that instead of the reported 4 million owed to creditors, its now a whopping 14 million.

DOCA

The Administrator has said "I have not received a proposal for a DoCA at the time of writing".

Dividend

He also said "based on the asset realisation and investigations to date, it is unlikely that there will be a return to any class of creditors".

Zero, zip, zilch, none. I wonder where that 14 million went...

Liquidation

He said "it is my opinion that the company be placed into Liquidation. The reasons for this opinion are detailed in Section 10 of this report".

Subbies to be sued for Preferential Payments

The Administrator said;

"I have conducted a review of the Company'$ records in my po$$ession for the relevant period and have identified $everal tran$action$ that require further inve$tigation".

If these transactions relate to payments to directors or related family or friends, by all means, go for it but if there is no prospect of a dividend now or in the future, who benefits from $uing $ubbies for preference$?

Yes you guessed it, the liquidator and his lawyers.

Directors Explanation

The director Dan Burley said:

"The failure of the company was caused by the Developer of Citro Apartments Project refusing to pay 3.1 million in owed monies for the current progress claim plus considerable EOT's that were in dispute (yet the developer still instructed the Superintendent to apply LD's) as well as over 2 million in unapproved variations that were also in dispute".

At this point I have a couple of questions;

- How does the non payment of 3 million cause the loss of 14 million?

- Where was the working capital required under the MFR's for their licence category?

- Who in their right mind (NOT certified insane) would do 2 MILLION, ($2,000,000) in variations for anyone, especially a developer, WITHOUT approval?

Pre Appointment Sale of Property

On 29th January 2018, the company sold and leased back the property at 25 Argon Street Sumner Park Qld for $2,075,000 to a related party, Walter Sommer Pty Ltd.

The Administrator said "I am of the opinion that this transaction was commercial and reasonable and was not completed with the intention to defraud creditors."

You can all form your own opinions about the timing of this transaction, I know I have.

Sommer and Staff have been in a world of pain for at least 18 months and possibly longer which means that subbies have been in a world of pain for all that time.

Now some of them will be faced with the prospect of being sued for payments they received in good faith for work completed by them and their staff and the major beneficiaries of these litigations are without doubt, Liquidators and Lawyers.

2nd Meeting Of Creditors

Creditors should turn up to this meeting in numbers, its you who have lost large sums of money and its you who will be sued for voidable transactions.

The only way to avoid a complete wipeout of preferential litigations is a Deed of Company Arrangement.

The meeting is on Monday 22nd of October 2018.

11.30am Novotel Hotel, 200 Creek Street Brisbane Qld.

This swamp needs to be drained.

Part A of the creditors report can be read here.

Part B of the creditors report can be read here.

17 September 2018

We have been hearing a mountain of negative feedback on Sommer and Staff for 12 months, we are surprised they lasted as long as they did. That can only be due to patience and support from subcontractors and suppliers who hoped for the best outcome.

Amost 12 months ago, on 6th of October 2017 I received an appointment email from someone at Sommer and Staff in regard to a comment left on a blog I wrote and a possible meeting with the director/general manager.

Following is my reply:

- Has Sommer & Staff had pre insolvency advice?

- If so, what is the name of the company giving the advice?

Our sources on the 6th of September 2018 were correct when they said "today financial analysts are in attendance at Sommer and Staff's office and are investigating the company's financial position to ascertain if the company has been trading insolvent".

The appointment of an Administrator also reaffirms why on the 5th of September, the QBCC's placed an immediate suspension on Sommer and Staffs license.

Cleary they have been trading insolvent for a long time, leaving in their wake a large number of subcontractors and suppliers owed many millions of dollars.

We smell a Deed of Company Arrangement (DoCA) on its way.

There are a few ways to look at this, if its a DoCA subbies won't be dragged though the "preferential payment" minefield like the Cullen Group subbies are at the moment.

The DoCA option is decided by a vote of creditors at a creditors meeting.

One option of an Administrator is to save the company by restructuring it through a rough patch and allow it to trade again in the future. To do this they may formalise an arrangement with creditors by offering them a percentage of each dollar owed to them, usually a very small percentage.

Priority or secured creditors are paid first, depending on the terms of the DoCA.

But in this case, there have been numbers in the vicinity of 9 million owed to creditors and if they are saying 9 million, it will more than likely be a lot more.

Administrators are not the best at taking on developers to fight for unpaid claims and cashed bank guarantees with a view to returning a percentage back to creditors so where does this leave subcontractors?

Hugely out of pocket no matter which way they vote.

As more information comes to hand we will keep creditors informed.

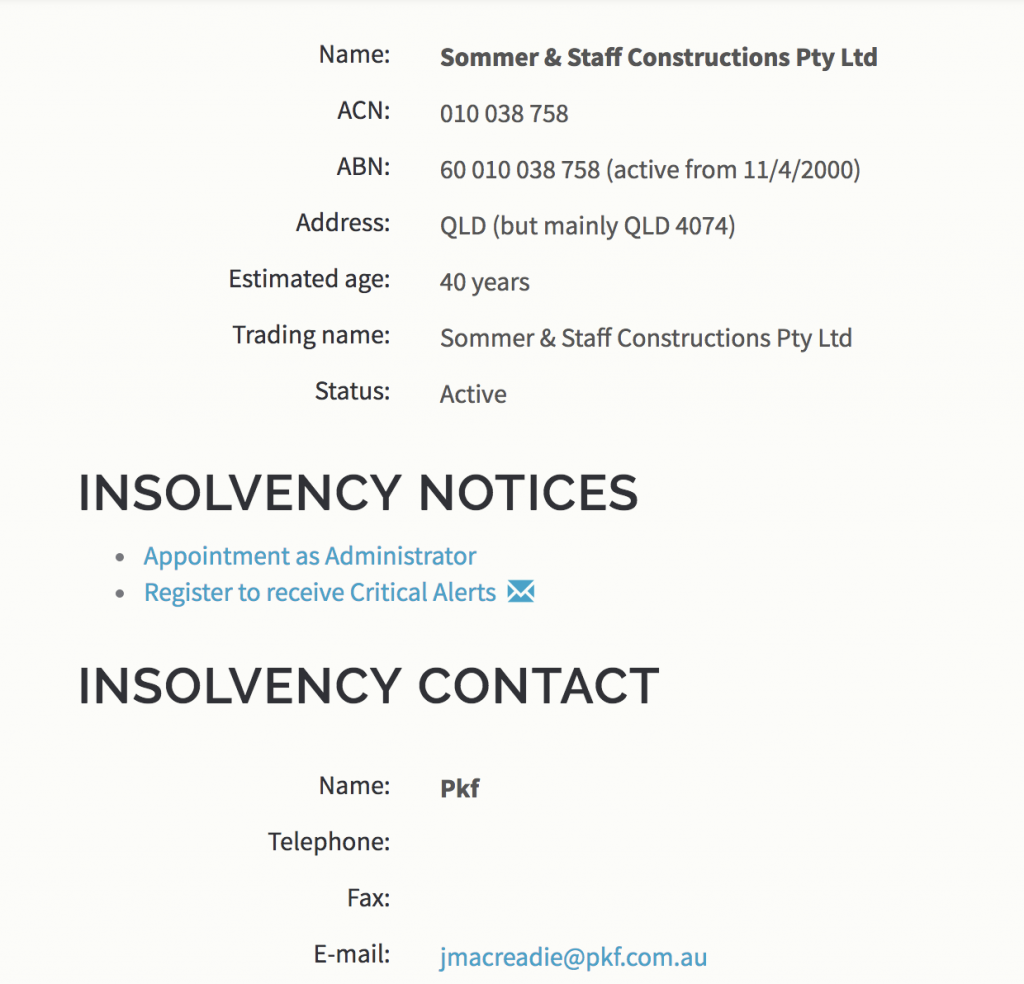

Below is courtesy of www.insolvencynotices.com.au