Fighting For Subbies Rights

Updated 14.11.17

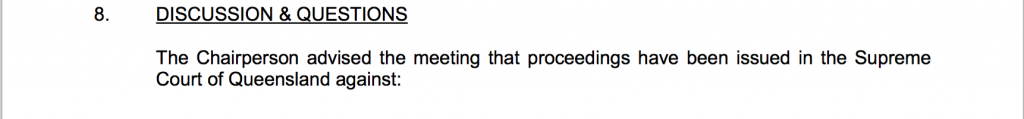

The Chairperson advised the meeting that at an ex-parte hearing of the Supreme Court of Queensland on 7 November 2017, he obtained a Freezing Order over specific assets of all five (5) respondents.

The news out of todays Q1 creditors meeting is good for all subbies but not so good for the director of Q One Homes and Empire Constructions. Finally Queensland has a liquidator prepared to do his job, to investigate liquidating building companies.

All liquidators are duty bound to do this but do you think they all do? You know the answer to that.

You can read the creditors report here but below is the most interesting excerpt.

This order is subject to the respondents having their say on the return date being 23 November. 2017.

We also note that Q1's pre appointment solicitors have ceased acting for the respondents. Time will give us the answer as to why.

This makes interesting reading:

Updated 27.10.17

The complete report to creditors lays bare the behaviour of the Q1 Director. The report has been lodged with ASIC so we can only hope they put an end to this totally uncooperative and despicable behaviour.

When the company was liquidated the director estimated the liabilities of Q1 was 1.6 million but after his preliminary investigation, the liquidator estimated that the liabilities are in excess of 5.9 million.

There is evidence of Illegal Phoenix activity, missing documents and company records, a lack of cooperation with the liquidator but most importantly grossly overstated Work in Progress in 2015, 2016 and 2017 which inflated the value of the company's financial position and allowed them to keep their QBCC license long after the company was insolvent.

These inflated figures were used by the company and it's financial advisors to satisfy the QBCC's minimum financial requirements.

This allowed them to continue to trade while insolvent and that led to the current situation were creditors are in the hole for in excess of 5.9 million dollars.

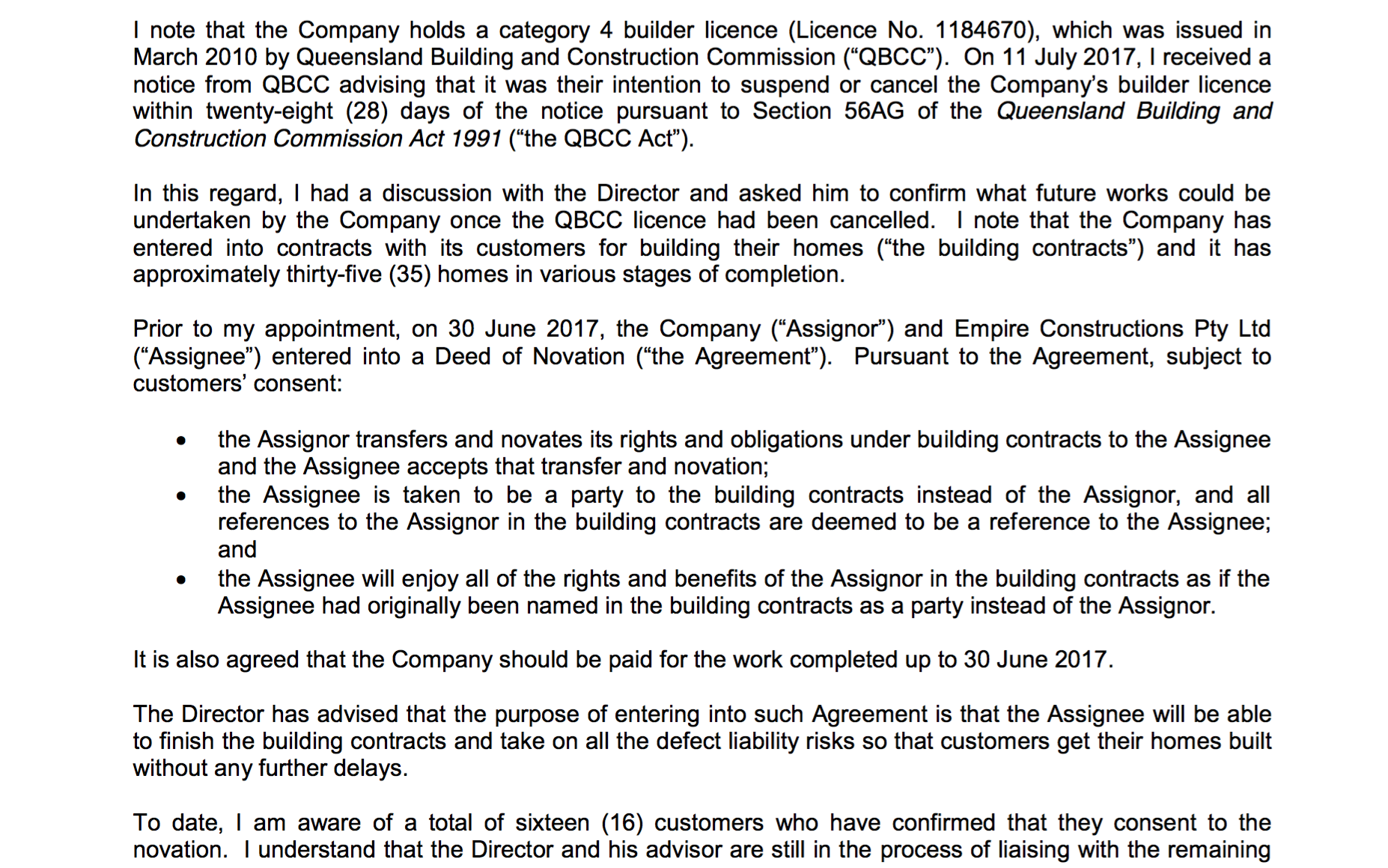

In the report Michael Caspaney states;

"Prior to the company being placed into liquidation on 6 July 2017, the company entered into Deeds of Novation for most of its building contracts and transferred its rights and obligations to a related entity known as Empire Constructions Pty Ltd. Although the Deeds contemplate an amount to be paid to the company, there is no mention of any consideration that should be paid.

I have requested that Empire provide me with details of the accounting position of each of the novated contracts and to date I have not received any information that would help me to form an opinion as to whether or not these deeds are commercial".

"In the absence of appropriate accounting data from the company or from Empire, I have obtained information from various sources that has allowed me to come to a preliminary position that Empire could owe the company more than $400,000 for the work in progress not charged to the company’s customers for work done by the company".

Illegal Phoenix Activity

The report continues;

"If Empire does owe the company (Q1) approximately $400,000 for the novated contracts, the transmission of those contracts for zero consideration can be labelled as phoenix activity. My investigations are continuing.

Mr Caspaney said;

"It is my opinion that if the true financial position of the company was stated in its financial reports as far back as 2015 and 2016, the company would not have been able to maintain its QBCC licence".

The report continues;

"My opinion about the work in progress and the commission levels that were paid by the company would be enhanced if the director elected to co-operate with my investigations. However, due to his lack of co-operation I will be endeavouring to conduct public examinations involving all relevant stakeholders in the near future".

"Given the limited information, including the lack of books and records, that has been provided to my office, my opinions here will evolve once more meaningful information is collected and I am hopeful that the anticipated public examinations will shed more light on this position".

Liquidator of Bluestone Constructions Worrells take note;

- This is how a liquidation investigation should be done.

Updated 22.09.17

We Have and Always Will Pay Subcontrators.....

As reported by Kathleen Skene in today Gold Coast Bulletin;

"THE director of a Gold Coast building company, which is currently under investigation by the state’s building watchdog, has vowed it “has and always will” pay subcontractors what they’re owed.

Some subcontractors have demanded payment in advance from Empire Constructions Pty Ltd since the Gold Coast Bulletin revealed the company was being investigated by the Queensland Building and Construction Commission".

Adjudication Decision

There are subcontractors who would disagree with that statement. SubbiesUnited has evidence that Empire Constructions owed a subcontractor $110,000 for a job in Northern NSW for work completed in December 2016. When they threatened the Q1 director with QBCC action, they were laughed at and told, "they can't help you, the job is in NSW".

The Landscaper had to go though a long process of adjudication in NSW as it is outside the QBCC's jurisdiction. The cost of the legal action added to their financial pressure but they did it and followed it though on principle.

The debt of $117,000 was paid last week, 9 months after it was due and not without a lot of angst, legal action and expense.

This morning the subcontractor told me they received the money at the last hour on the last day before windup proceedings were to begin.

The director vows they "have and always will pay subcontractors" If that is paying subcontractors in a timely manner, then I'm a monkey's uncle.

Read Kathleen Skene's story here

Qld One Homes Customers Heartbreak

Kathleen Skene has been busy, here is another story in today Gold Coast Bulletin about a Qld One Homes customers heartache.

THE sunlight streams into Rod Mattingley’s brand new home.

Trouble is, it is coming from underneath the wall instead of through the windows.

The customer of collapsed Gold Coast builder Queensland One Homes is a year into his nightmare dealings with the company, and now with its related company Empire Constructions Pty Ltd, which has taken over building his new home.

Out of the frying pan, into the fire..

Read this broken dream story here

Updated 12.09.17

Reading between the lines here, it is clear that the director has severely breached his fiduciary duty by not providing the company files to the liquidator. There are heavy penalties for breach of those duties.

This is a particularly nasty effort to defeat creditors and makes some of the preceding liquidating directors look like choir boys by comparison.

I hope ASIC throw the book at him, it's time one of these shonky bastards went to gaol.

Updated 19.08.17

Once again SubbieUnited on behalf of our members, thank the Gold Coast Bulletin and in particular, Kathleen Skene for highlighting the lack of action by the QBCC which in this case has contributed to costing creditors a reported 3.5 million. I reiterate that there are times they can't act but surely they could refer it to ASIC, the Queensland Police Force or the Federal Police.

Anything would be better than sitting by and watching subbies burn.

The QBCC is hamstrung by totally inadequate legislation and fatally compromised by the dilemma they have of keeping the organisation financially in the black with it's profitable home warranty insurance and on the other hand, regulating licensees.

It cannot do both and claim to be independent.

I am hearing that the company under investigation for alleged illegal Phoenix activity is so desperate to get subbies on board, they are paying some of them up front and in full.

Developer Licenses

Another point that has to be raised is that developers should be licensed. They get away with Blue murder and very little is said or done about it.

I have evidence of a builder who liquidated his company.

Not long after he must have thought how good is this, "I have just made millions with the stroke of a pen" so he set up a development company that doesn't need a license and a few months ago, he liquidated that company owning subbies and a Civil Contractor a huge amount of money.

Before he liquidated the development company, he had already set up a new company with the same name, the only change was (QLD) in brackets and so he continues on his merry way with his tried and true get rich quick scheme and no one is doing anything about it.

This behaviour is an outrageous abuse of subbies and suppliers who trusted him but some of them will be stupid or desperate enough to work for the new entity like they did with Q One and the Phoenix.

He has now done it twice and there is no doubt that now he has the Blueprint, the dishonest bastard will do it again.

We currently have a job where a large payment was due on Monday 14th August. When we finally got in contact with the principal of the company yesterday and asked why payment hasn't been made, he said, "we hope to make this next week, sorry I have been out of the office".

Our employees and suppliers "hope" to be paid next week too but if everyone treated subbies like this, no one would get paid.

Why should I be up at 11.30 pm texting a developer who used the excuse that he was "out of the office"? Has he not heard of a mobile phone or internet banking? You can pay an account from anywhere in the world, I have on numerous occasions.

The industry can't survive on "hope" and neither can subcontractors.

While its clear from Q One Homes and all the other liquidations this year that a license offers little protection for subbies, it is better than a kick in the arse (only just) so consideration should be given to developer licenses to make them in a small way, accountable.

Read the latest Gold Coast Bulletin story here.

You can also read Condev Constructions Managing Director Steve Marais's warning that a building industry blood bath is coming.

All I can say is that this year has already been a bloodbath, and while I don't like to contradict him, I believe he has got it wrong, its a holocaust coming.

----------------------------------------------------------------------------------------------------------------------

Updated 18.08.17

Gold Coast Bulletin reporter Kathleen Skene is relentless on this story and rightfully so because it needs to be told.

In today's Gold Coast Bulletin story on Queensland One Homes, a home owner alleges he is $100,000 out of pocket after nightmare dealings with Queensland One Homes.

The home owner hired a private inspector who found 96 defects and while the builder didn't do the plumbing, landscaping and the balustrade, he is responsible to make sure the work is completed to standard.

This goes to the heart of what we said yesterday in regard to someone who is not a builder being allowed to operate a building company. Defects are rampant because they don't have the knowledge to identify or to rectify them.

As to evidence provided to the QBCC in 2016 of the solvency of Q One, there are mitigating factors as to why the evidence may not have been acted on.

There are times when the QBCC cannot use information under the current QBCC Act and in law, for example;

- If the evidence provided is subject to court privilege they are precluded from using it in any way, the same applies to the ATO and to all of us.

I believe that the Minister for Housing and Public Works Mick De Brenni is working hard with Les Williams from Subcontractors Alliance to make changes that will offer more protection for industry participants but that takes time and with an election looming, he may not have the time he needs.

He will meet stiff opposition from groups such as the MBAQ but as we know from their anti Project Bank Accounts advertising campaign, they want what subbies don't want.

Subcontractors Alliance works tirelessly for the rights of subcontractors at their own cost, they need your support so click here and donate to this very worthy cause.

-----------------------------------------------------------------------------------------------------------------------

Updated 17.08.17

Today we have another excellent article you can read here, written by Walkley Award winning journalist Kathleen Skene from the Gold Coast Bulletin.

On behalf of our members, I want to thank Kathleen for her support of the industry.

It beggars belief that the QBCC legislation could allow a husband and wife team comprising of a failed director of a liquidated building company and a registered nurse, to run a Category 2 building company with a license capacity of 12 million with the livelihood of dozens of subcontractors at stake yet again.

He is not a builder, she is not a builder yet they are allowed to operate not one, but two large building companies with one now in liquidation.

If the company meets the criteria, the QBCC must give them a licence so we need the legislation changed so that the bar is set higher with requirements for a level of skill and knowledge of the building and construction industry.

What does it take to run a Construction Company?

I have been in business in the building industry for 30 years, I run a group of companies but I could not run a construction company. I do not have the intricate knowledge required to do that even though I started out as a carpenter many years ago.

It takes knowledge and expertise that I don't have and neither do they.

This is why the building industry is in deep trouble. If a builder with 30 years experience can fail as happened recently, how is a nurse with no experience expected to succeed?

To successfully manage a building company, this is some of the criteria;

- Technical knowledge of the industry is paramount, why?

- If you run into a problem, you need to be able to direct qualified staff on how to rectify the issue.

- How can you do that if you are not qualified yourself? Ok, you have a nominee, does he have all the knowledge required to operate a successful construction company?

- You need to liaise with architects, engineers, hydraulic consultants, electrical contractors, civil engineers.

- You need sound knowledge of council regulations, building legislation and the ability to administer building contracts.

- A builder needs to have an intricate knowledge of sales, estimating and programming of projects.

- A builders needs to administer and manage budgets, costs, cash flow and cash flow projections.

You don't have to be a rocket scientist to know that the industry is in a terminal state when a nurse fresh out of theatre is allowed to own and be sole director of a building company that is allegedly under investigation for illegal Phoenix activity.

What about the subcontractors and suppliers wracking up millions of dollars of Work in Progress for that company? Where does it leave them if the investigation proves illegal Phoenix activity?

This company has millions in contracts novated from the husbands failed Queensland One Homes, where does it leave the home owners?

The industry is a mess and needs urgent repair so please Mr De Brenni, get to work and fast on a solution to this failure of the system.

Who in the QBCC allowed the novation of these contracts? Why did they allow it? Was it to protect their Home Warranty Insurance?

They have allowed the Phoenix to occur, illegal or otherwise, then after the fact they are investigating when it's too late to protect those who have provided product and services to this company.

The legislation that allows this to happen is a shambles, it is an abject failure on the part of successive Governments past and present.

-----------------------------------------------------------------------------------------------------------------------

Updated 16.08.17

Kathleen Skene has written an excellent story on Queensland One Homes Pty Ltd and the QBCC investigation into the possibility of illegal phoneixing by Empire Constructions Pty Ltd. The article is on the front page of todays Gold Coast Bulletin, The Courier Mail and the Sunshine Coast Daily.

It's great to see local news outlets supporting subbies in their fight for a fair go and the exposure of corrupt builders they put their faith in.

Anyone find it strange how the assets of the director and his wife as listed in the Gold Coast Bulletin, are very similar in value to the debt owed to creditors, approximately 3.5 million? The property listed in the Bulletin is valued at 3.33 million.

You would have thought that if they owned millions of dollars in property, sold their home in March for 1.8 million, why couldn't they sling a mil or two into Queensland One to pay it's creditors instead of liquidating the company and your hard earned with it.

Unsecured Creditors

During the process of changing the liquidator, I have talked to almost every unsecured creditor, their anger is palpable, the damage to their businesses is enormous, they are filthy on the system and law makers who allow this to keep happening.

The QBCC have known about this rort as early as 7th February 17 but it still happened.

Liquidator Michael Caspaney said "It's only 2 weeks since our appointment, we are currently looking for the companies assets, books and records.

There are a lot of loose ends here". Anyone with any information can contact Mr Caspaney on;

- Phone 07 4222 1511 or email

- michael@menziesadvisory.com.au.

Company Records - This is a particularly nasty liquidation

It has come to SubbiesUnited's attention that the previous liquidator failed to secure the company records and computer hard drives despite having 18 days to do so and that is a travesty of justice for all creditors.

We have since learnt that someone from Queensland One Homes left the company computer in the back of an open ute overnight or over a number of nights. When retrieved, all internal components were wet and the hard drive was wiped. I believe this would be an offence and trust that the new liquidator will track down and prosecute the person or persons responsible.

Some racketeers think they can walk roughshod over subcontractors and just thumb their nose at people just doing their job. They should rethink their commitment to crimes against subbies because SubbiesUnited and Subcontractors Alliance will not stop until we see someone go to jail and get positive changes to the industry.... and that includes the QBCC.

The story also appears in todays Courier Mail.

Protection against the Rort

One of the best ways to protect your company against the rort of liquidating builders is to take out a trade credit insurance policy.

We have two companies who advertise on our website who can provide you with quotes.

Get two quotes, they cost you nothing, there can also provide you with options to pay it off so it's not one hit to your cash flow.

27.07.2017

Today at the first creditors meeting, the incumbent liquidator conceded in a professional manner to Michael Caspaney of Menzies Advisory as Liquidator of Queensland One Homes after a vote of almost 3 to 1 in favour of the change.

Michael Caspaney will work for creditors which is a rare thing in the insolvency world, SubbiesUnited trust him and so can you.

He is happy to take any calls or answer emails from creditors. He can be reached by phone:

07 4222 1511 or email; michael@menziesadvisory.com.au

Well done to all who voted for this change and I reiterate, it's nothing personal against the incumbent Liquidator.

Why change the Liquidator

- The change of a builder appointed Liquidator is necessary to ensure that the appointee represents the creditors and not just those who voted for the change, he is there to represent ALL creditors.

- It is also vital to send a clear message to builders who think they can liquidate subbies and suppliers debts away with the stroke of a pen. For too long it's been a free for all with little or no consequences for those who prey on subbies and suppliers.

- SubbiesUnited make no apologies, we will take any opportunity which presents itself without fear or favour to change a builder appointed Liquidator to one appointed by the victims.

- Any builder or company director who wants to take the value out of a company and move it forward to their Illegal Phoenix company will now have to answer to a creditor appointed Liquidator who has a mandate to do a thorough investigation.

Preferential Payments

There is a perception that only new Liquidators will sue creditors who have received preferential payments but in fact it's a statutory obligation that any Liquidator has to investigate and identify all preferential payments and take action as they see fit. The cut off point would be approximately $10,000, any less than that and the legal costs make it noncommercial.

- The basis for a preferential payment is where a director has paid amounts to family or friends and unfortunately some creditors get caught up in that.

- In general principal, if a creditor has been paid a lump sum not in line with their invoices, that could also be classed as a preferential payment.

Statement from a Brisbane Liquidator

Yesterday we received an email from a Brisbane Liquidator who made the most telling of statements and rammed home what we have said many times about the damage caused by Pre Insolvency Advisors to subbies and suppliers (liquidation creditors) when he said;

- I’m personally supportive of the balance of power back in creditors’ favour. The debtor-friendly environment, in conjunction with pre-insolvency advisers and liquidators who choose to take appointments from them on a ‘friendly’ basis has ruined the SME insolvency industry.

He is 100% correct. SubbiesUnited could not agree more and are relieved to see that those who work in the industry recognise the damage that is being done to creditors and the industry itself.

The law is changing on the 1st of September. If creditors are not happy with an appointed liquidator, they can get together and vote them out to appoint their own.

Read Sydney Insolvency News report on this change of liquidator here.

Once again, today creditors have spoken.